What is a Head Shop Merchant Account?

A head shop merchant account is a credit card processing account specifically tailored to meet the needs of head shops. These businesses generally specialize in selling smoking accessories that include pipes, glassware, bongs, hookahs, vapes, tobacco, cigars, and other related items.

- Market Size: $71.07 Billion (Global Smoking Accessories Market including Headshop Paraphernalia) (2024)

- Projected Market Size: $97.6 Billion (2031)

- CAGR: 4.7% (2024–2031)

- Top Growing Region: Asia-Pacific, North America, South Asia, Oceania

- Online Transaction Growth YoY: 4.3% (Smoking Accessories Online Sales)

- Average Transaction Value: Data not available specifically for Headshop Paraphernalia

- Key Growth Drivers: Cannabis legalization, Premium products, Personalization, Eco-friendly, E-commerce expansion

- Leading Customer Segment: Millennials

- Tentative Global Online Business: Data not directly available; online channel rapidly expanding

- Digital Payments Adoption Percentage: Estimated 80%+ in developed markets (general e-commerce context)

- Top Market Opportunities: Premium & personalized smoking accessories, online direct-to-consumer sales

- Data Source: QuadraPay Internal Research Team, GMI Insights, 2024 Future Market Insights, 2025 Data Bridge Market Research, 2024 Persistence Market Research, 2024 IMARC Group, 2024 Emergen Research, 2025 Statista, 2025 Grand View Research, 2024

There are many reasons why a head shop merchant account is necessary for businesses in this specific segment. As a merchant, you must understand that processing payments for industries like head shops or smoke shops requires extensive experience in supporting high-risk businesses. Conventional credit card processing companies generally do not have enough risk appetite to support online and retail businesses from these sectors.

At QuadraPay we specialize in providing credit card processing solutions to merchants in the head shop industry, and we have been doing so since 2016. Our services are extremely beneficial for merchants who have been rejected by mainstream credit card processors. We believe in offering competitive rates to merchants in high-risk industries so that they can not only sustain but also grow their businesses.

Why Are Head Shops High Risk for Payment Processing?

| Processor Type | Supports Head Shops? | Chargeback Tolerance | Risk Profile | Typical Outcome |

|---|---|---|---|---|

| Low-Risk Processors | ❌ No | Low | Low-risk only | Account frozen / rejected |

| High-Risk Processors (QuadraPay Partners) | ✅ Yes | Moderate | High-risk approved | Stable long-term processing |

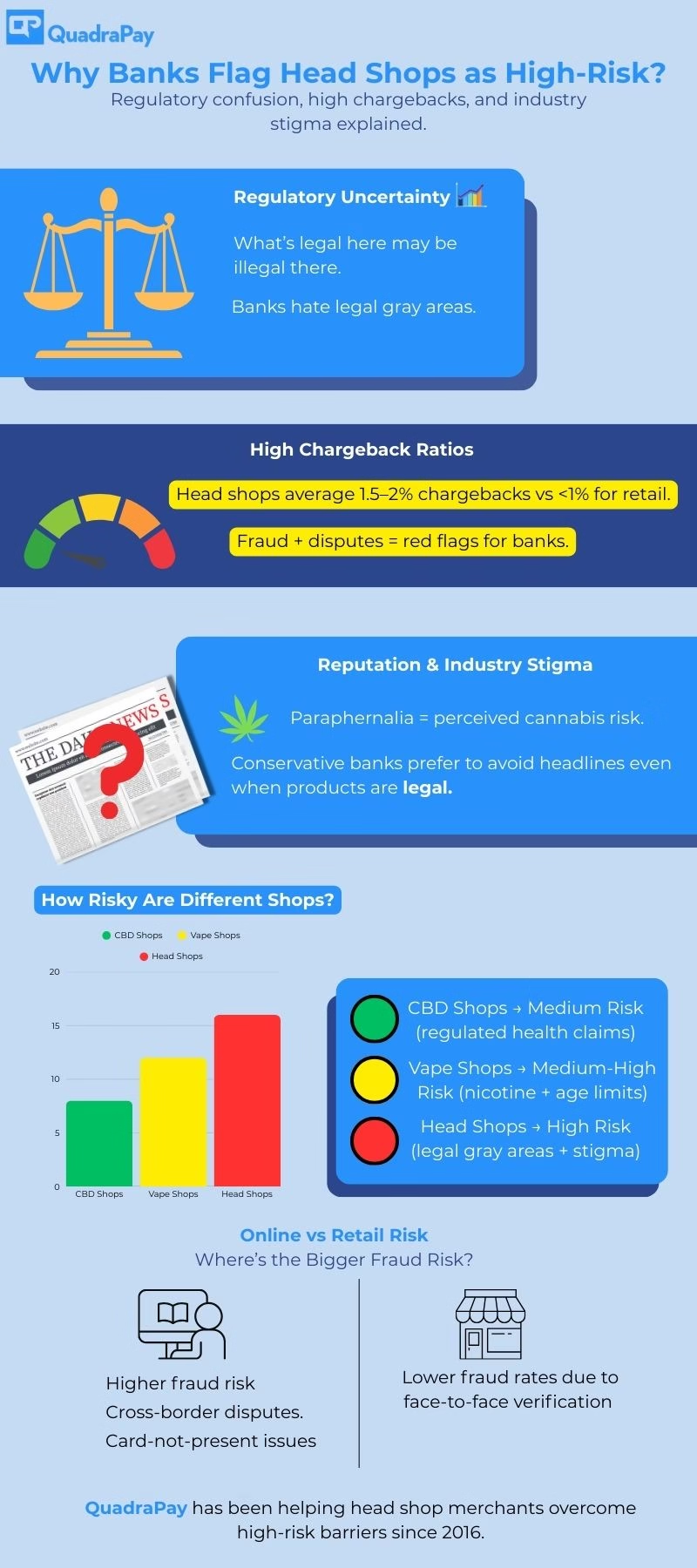

Head shop businesses often possess unique regulatory and reputational challenges. This is why banks and payment processors often categorize such business industries as high-risk. Several acquiring banks are cautious about onboarding businesses that sell smoking accessories classified for pipes, bongs, hookahs, and vapes. Although these products may be legal in most jurisdictions, their association with cannabis-related paraphernalia can trigger higher compliance scrutiny. For several financial institutions, such businesses are seen as a wing that is exposed to increased risk. This is why head shop merchants frequently face rejection from mainstream providers such as PayPal, Stripe, and Square.

Another major reason that significantly contributes to the classification of this industry as high-risk is due to its chargeback ratio. Buyer’s remorse disputes and fraud attempts are more frequent. Moreover, online sales of such products amplify these challenges even more. This is mainly because the “card-not-present transactions” inherently carry higher fraud risks compared to in-store transactions. Which is also why banks prefer industries with predictable sales patterns and low refund rates. However, this is not always the case for smoke shops.

There is also a key and significant difference between the online head shops and brick-and-mortar locations. Physical or retail shops typically benefit from face-to-face transactions. This drastically reduces the risk of fraud and identity theft. But, on the contrary, online head shops must navigate cross-border sales, international card acceptance, and compliance with multiple jurisdictions. So, compared to CBD and vape merchants, smoke shops face more complex regulatory scrutiny because of the stigma tied to cannabis and paraphernalia, even if the products themselves are fully legal.

For example, CBD merchants are bound by strict guidelines from the FDA or Health Canada. On the other hand, vape shops must comply with nicotine-related laws. Head shops, therefore, find themselves in a grey area that is legal yet is burdened by regulatory guidelines that put them under a sharper lens.

QuadraPay Specializes in High-Risk Head Shop Merchants. Start Your Application.

Legal & Compliance Requirements for Head Shop Accounts

Having a strong understanding of both the local and international compliance rules becomes mandatory to run a headshop successfully. In the United States, head shops are legal in most cities and states, provided that the merchants clearly state mandatory disclaimers. However, some states interpret paraphernalia laws more strictly. This means that even a missing or vague disclaimer can create serious legal risks for the shop owners. In Canada, head shops are generally permitted; however, regulations vary from province to province, especially in regions where cannabis retail overlaps with smoking accessories.

In the United Kingdom and the EU, head shops are legal; however, they are subject to strict oversight. For instance, in the UK, the law enforces tough age verification requirements, particularly for vapes and e-cigarettes. Within the EU, Member States apply directives like the Tobacco Product Directive (TPD), which regulates labeling, advertising, and online sales across borders. However, on the contrary, Australia and New Zealand take an even firmer approach. In these places, the laws impose heavy restrictions on the import of certain smoking accessories.

By 2025, these regulatory frameworks will have only become more demanding. In the EU, the authorities have tightened age-verification standards for online sales. Canada has expanded provincial oversight on e-commerce transactions for headshops. Meanwhile, in the U.S., the laws continue to operate under a patchwork of state-level rules, thereby making compliance an uneven and sometimes confusing process for merchants. Here, the burden of proof is high for those seeking credit card processing approvals. Documented evidence of compliance with age verification, accurate product labeling, and responsible marketing practices becomes unnecessary for merchants and processors. Applicants who fail to meet these requirements not only risk rejection during their application process but also face the possibility of mid-term account closures for non-compliance.

How to Get Approved for a Smoke Shop Merchant Account

Provided with such circumstances, the approval of your application might seem questionable and dicey. However, it’s not impossible! Securing a Head Shop Merchant Account becomes significantly simpler and easier if you prove that your business operates with strong practices and a compliance-first approach, which basically means that your business abides by all the rules and laws of the particular state or place you want to operate your business in.

One of the most important steps is maintaining chargeback ratios below 1%. This can be easily achieved by offering a clear and accurate product description, publishing transparent refund policies, and providing responsive customer support. Making your policies simple and customer-friendly goes a long way towards reducing chargebacks. This also reduces many disputes stemming from customers feeling misled or frustrated by unclear return processes.

Now, the second yet essential and critical, factor is the age verification. Since Head Shop sells products restricted to buyers over 18 or 21 years of age, depending on the jurisdiction, using a reliable digital age verification tool is essential. Doing so not only demonstrates that you take compliance seriously but also helps mitigate the risk of underage transactions. On top of that, partnering with licensed suppliers and acquiring documented proof of your inventory further strengthens your application.

Lastly, both your physical store and website should reflect professionalism and compliance. Make sure that you always include disclaimers such as “For Tobacco Use Only.” Also, do not forget to ensure that your payment gateways are safe and reliable. Every sign of visible transparency and responsibility would assure the financial institutions that your business is operating in good faith. The stronger the evidence you present, the greater your chances of your applications being approved, even within the high-risk category of Head Shop businesses.

Features and Benefits of Head Shop Payment Solutions

Head shops generally face extreme challenges when they try to get approved for credit card processing accounts. There are multiple reasons behind it; however, the common reasons include regulatory challenges and the reputation of the industry. However, when you work with a high-risk merchant account provider, this is not a big challenge. High-risk merchant processing for head shops is the perfect solution for businesses that are struggling to find credit card processing for their businesses. These accounts are optimized to suit the requirements of head shop companies and also comply with the industry requirements and guidelines.

With a head shop merchant account, businesses can easily accept payments from customers using well-known payment methods such as credit cards, debit cards, and other alternative payment methods like electronic checks. The ability to allow customers to make payments using their preferred payment methods can have a significant impact on the overall sales of the head shop, as well as the overall customer experience.

It’s quite common for modern head shops to sell their products both at a retail location and online. With a head shop merchant account, businesses can securely accept transactions online and at the store, which helps expand the reach of the company to customers beyond the local area.

An experienced head shop merchant account provider is highly skilled in understanding the legal regulations and various restrictions that must be adhered to when underwriting merchants from this industry. The merchant account provider implements various measures to mitigate fraud, chargebacks, and other potential legal issues. All these benefit the business in operating smoothly and remaining compliant with relevant laws and regulations.

High-risk merchant services made for growth

| Feature | QuadraPay Solutions | Conventional Solutions |

|---|---|---|

| High-Risk Acceptance | ✅ Yes | ❌ No |

| Global Multi-Currency | ✅ Yes | ❌ Limited |

| Chargeback Tools | ✅ Advanced | ⚠️ Basic |

| Transparent Pricing | ✅ Interchange+ | ❌ Hidden fees |

| Support for Online + POS | ✅ Yes | ⚠️ Limited |

With the growing demand for various head shop products like vapes, electronic cigarettes, paraphernalia, bongs, and hookahs, the demand for head shop merchant accounts has significantly increased. While the laws related to head shop businesses vary from country to country and state to state, many jurisdictions do allow head shop retailers to fully operate as a business. We work with highly experienced high-risk merchant account providers that help merchants from the head shop sector in obtaining a smooth credit card processing account.

We also ensure that these solutions do not restrict the merchant in terms of sales volume and other limitations. However, it is important to know that these solutions are typically a little bit more expensive than conventional credit card processing solutions like PayPal and Stripe. It is also worth noting that low-risk payment solution providers like PayPal and Stripe generally refrain from working with merchants from the head shop sector.

It is time for you to approach QuadraPay and let us know a few things so that we can immediately start working with you. At the start, we would need to know your website where you wish to sell the product, along with where your company is incorporated and what kind of sales volume you are expecting. You can simply provide us with this information by filling out the form on our website, and one of our representatives skilled in working with head shop merchants like you will contact you as soon as possible.

Rates, Fees, and Pricing for Smoke Shop Payment Processing

| Fee Type | Typical Range | QuadraPay Approach |

|---|---|---|

| MDR (Merchant Discount Rate) | 3–7% | Matched / Beaten |

| Gateway Fee | $0.10–$0.25 / txn | Competitive |

| Setup Fee | $200–$500 | Waived |

| Annual Fee | $100–$300 | Waived |

| Chargeback Fee | $20–$50 | Standard |

At QuadraPay, in most cases, we guarantee that we will either match or beat your existing pricing that you pay to your current credit card processing company. Merchants generally qualify for an interchange-plus model rate; however, a proper quote is only provided after evaluating the merchant’s complete risk profile.

In general, a head shop merchant pays a fixed percentage on each transaction, known as the Merchant Discount Rate. Additionally, for using the gateway, the merchant also pays a fixed amount on each transaction, known as the gateway fee. We generally waive any setup charges or annual fees, as we believe in offering competitive pricing to our head shop merchants.

With our head shop payment processing solution, businesses can accept payments from customers in multiple currencies. This is made possible by utilizing technology called dynamic currency conversion, which converts the pricing on the head shop website into the home currency of the user.

Required KYC Documents to Open a Merchant Account

| Document Type | Required For | Examples |

|---|---|---|

| Business Registration | Legal entity proof | Incorporation certificate |

| Director ID Proof | Compliance | Passport, Driver’s License |

| Address Proof | Business location | Utility bill, lease |

| Bank Account Proof | Settlement setup | Cancelled check, bank letter |

| Inventory Proof | Legitimacy | Supplier invoices, purchase orders |

Every merchant undergoes an application process, wherein the business is expected to submit a set of documents to the Merchant account acquirer for proper evaluation. In the case of head shop merchant accounts, these documents include the business registration documents and identification proof of all the directors. To validate the address proof of the business entity, utility bills are also required. Additionally, to ensure that the Merchant receives settlements in the correct business bank account, confirmation of the bank account details of the Merchant is necessary.

One of the most important documents for head shop merchants is the proof of inventory, which can be the invoice of purchased products or a supplier agreement confirming that the Merchant has available inventory. Along with these documents, the underwriting team may also request additional documents, as the requirements for KYC for head shop businesses keep changing. Merchants are expected to provide these documents along with the merchant account application form for faster processing of the application.

Approval Timeline for Head Shop Credit Card Processing Account

The approval timeline for a head shop credit card processing account depends on two factors. The most important factor is the willingness of the Merchant to provide all the documents in the shortest timeframe. If the Merchant is serious and provides all the required KYC documents promptly, as well as incorporates the modifications on the website as requested by the underwriting team, this can significantly reduce the approval timeframe. Another factor that plays a crucial role in the approval timeframe of a head shop credit card processing account is the availability of the Merchant processing solution and the availability of the underwriters. In the case of QuadraPay, we have multiple payment solution providers that work with head shop merchants, so we are confident that we can provide you with a head shop credit card processing account in a very short timeframe.

Integration Options: Online and In-Store Payments

Flexible payment integration has become mandatory for head shop merchants to work smoothly for both online and offline sales. For businesses operating online, payment gateways that integrate with platforms like WooCommerce, Shopify, and Magento are essential. Partners like QuadraPay offer APIs and plugins that enable easy integration of your e-commerce site with a secure merchant account. This thereby ensures a smooth checkout process for customers.

Having a POS system has become essential for physical headshops. Today’s shoppers expect multiple payment options, so terminals must support EMV, chip cards, contactless payments, and mobile wallets such as Apple Pay and Google Pay. It is important to have a POS system that syncs with your inventory management and also makes your day-to-day operations smoother. Such systems keep stock levels accurate while providing valuable sales insights. Advanced POS setups further enable detailed analytics. This thereby helps the merchants understand customer behavior and refine their business strategies.

Adopting a hybrid strategy is frequently the best course of action for companies that sell both online and offline. You can centrally manage transactions, settlements, and fraud monitoring from a single dashboard. This could be done simply by integrating your retail point of sale system and online gateway into a single merchant account.

Managing Chargebacks for Head Shops

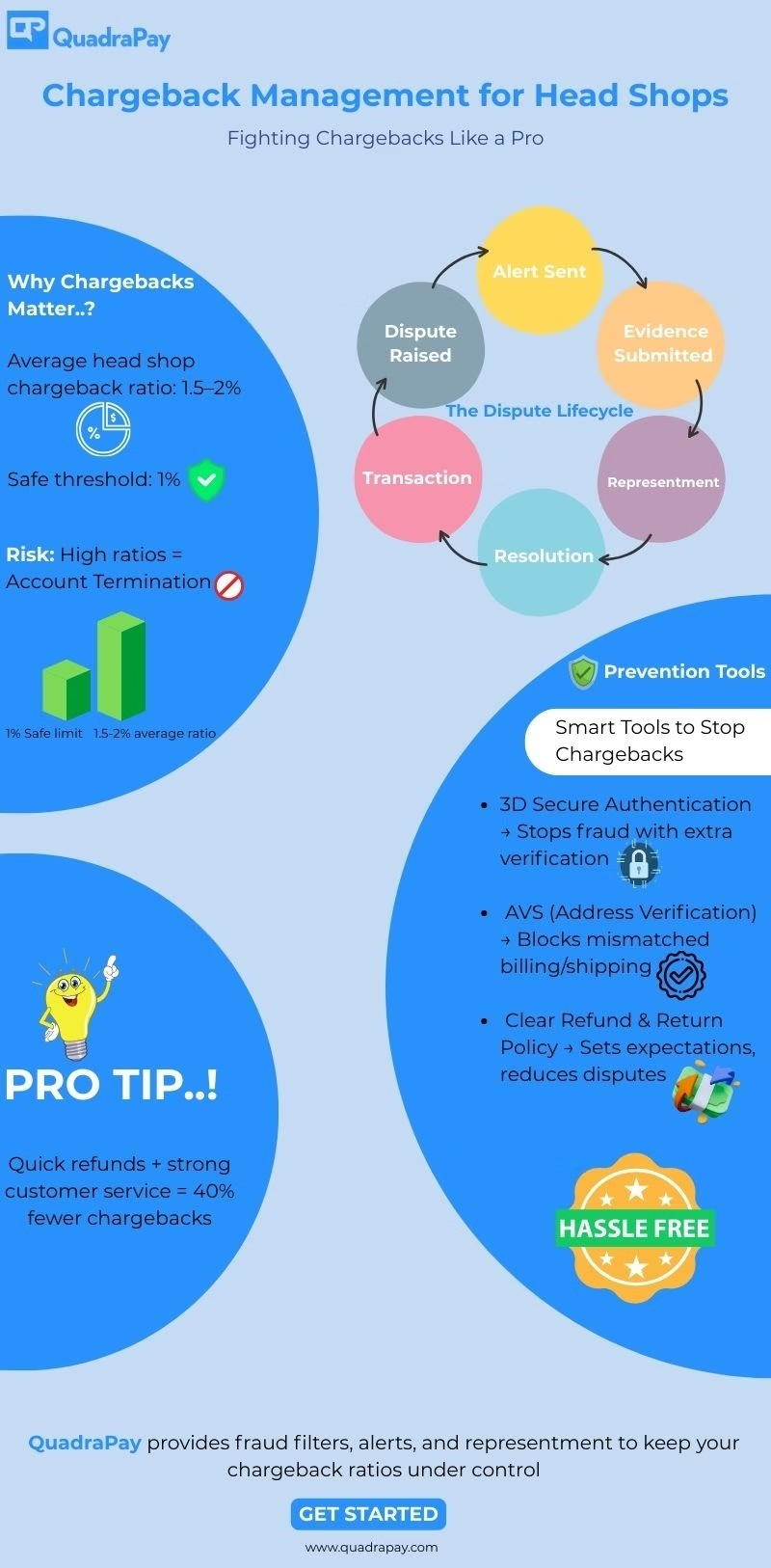

Chargebacks, unfortunately, are still one of the biggest problems for high-risk businesses like head shops. Chargeback rates in this sector usually differ between 1.5% and 2%. This rate is higher than what many acquiring banks are comfortable with. If you don’t handle a lot of chargebacks correctly, you could lose your merchant account or even end up on the MATCH/TMF list, which makes it very hard to get processing with other providers.

Using strong fraud prevention tools is the best way to cut down on chargebacks. 3D Secure authentication, AVS (Address Verification System), and real-time fraud alerts are some of the options that can help stop fake transactions before they are approved. Many head shop owners also benefit from signing up for chargeback monitoring programs. In addition to technology, proactive customer service is very important. Live chat support, clear communication, and quick refunds when necessary can all help cut down on the number of disputes that turn into chargebacks.

When chargebacks happen, representment services give merchants a chance to get their money back. Merchants can successfully contest illegitimate claims by providing proof like delivery confirmations, transaction logs, and records of communication with customers. Working with a high-risk payment solution provider like QuadraPay gives you access to advanced chargeback management tools and advice. Merchants can keep chargeback ratios under control and keep their accounts stable by using the right strategies.

Global & Multi-Currency Head Shop Payment Processing

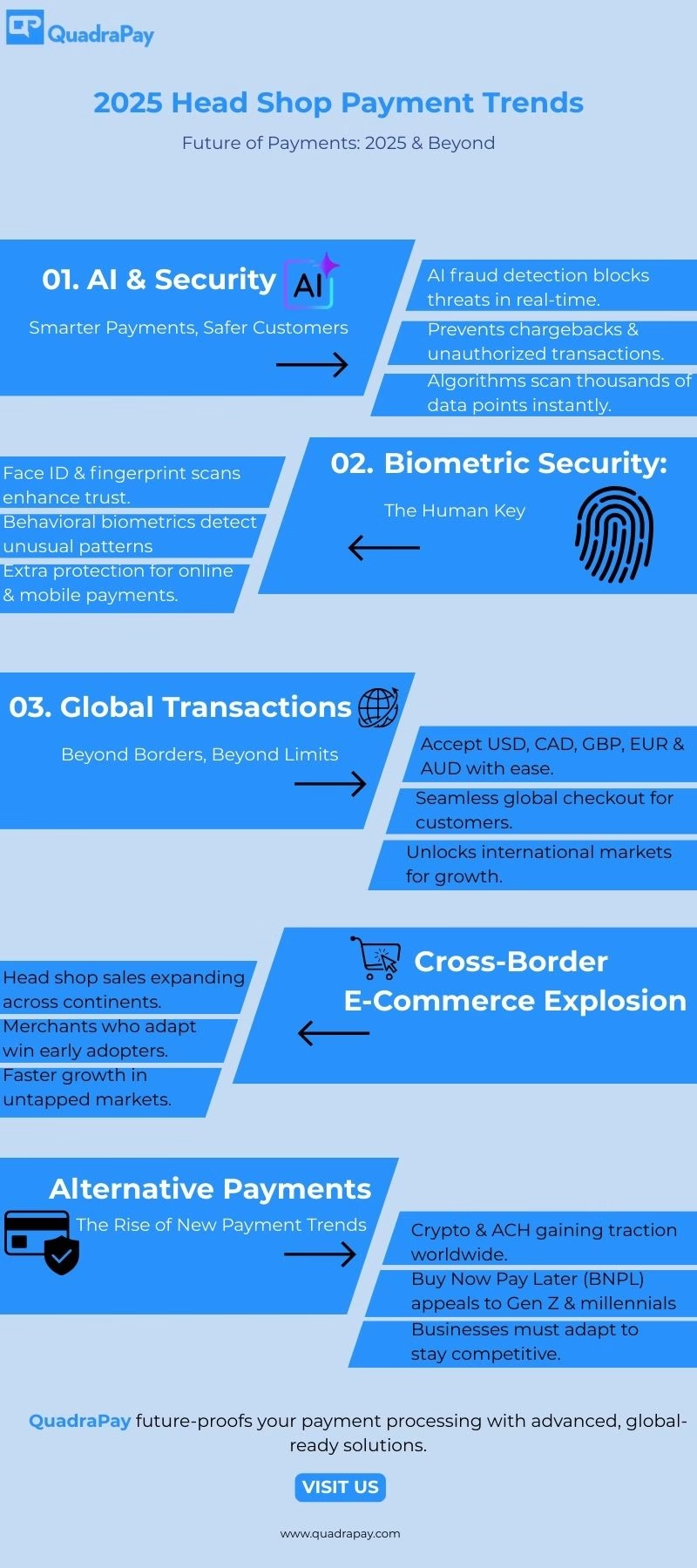

Most head shop businesses operating cross-border in multiple regions often run into challenges related to payments. QuadraPay helps merchants overcome this by enabling them to accept payments in multiple currencies. This includes conversion of currencies into USD, CAD, GBP, EUR, and AUD. This system and flexibility make it easier and more convenient to serve customers in the United States, Canada, the United Kingdom and Europe. For online head shop businesses, multi-currency capabilities are not just a convenience but more of a necessity.

Dynamic Currency Conversions, or DCC, further enhance the buying experience by allowing customers to view the prices in their own currency and in the converted currency as well and then pay accordingly. This cuts down the confusion at checkouts, builds trust, and lowers cart abandonment rates. Now, on the back end, merchants receive settlements in their preferred currencies. This simplifies the overall process, bookkeeping, and cash flow management.

Having said that, cross-border sales come with their own sets of risks as well. Such risks may include fraud attempts, chargeback risk, etc., which can vary significantly across different regions. Now, for example, EU markets require Strong Customer Authentication (SCA), while Australia enforces strict identification rules. Navigating these challenges and requirements can seem tough and complex without the right partner or guidance. Here is where QuadraPay steps in to help. QuadraPay specializes in structuring merchant accounts for global acceptance. We help head shop merchants to stay compliant while expanding internationally and maximizing cross-border sales opportunities.

Case Study: How a Texas Vape Shop Grew Sales With QuadraPay

At the start of 2023, a mid-sized Texas vape and head shop turned to QuadraPay after being rejected by several well-known payment processors. The company’s ability to expand was limited by high decline rates and frequent account freezes, despite the fact that their online sales were growing quickly. They needed a trustworthy high-risk merchant account that could facilitate both online and offline transactions with ease.

QuadraPay paired the merchant with a processing partner that specialized in head shop underwriting after a brief pre-check and document review. The account was approved in five days. In order to ensure smooth operations both online and offline, the company then installed updated point-of-sale terminals throughout its two retail locations and integrated its WooCommerce store with the new payment gateway. By the end of the year, the store reported a 200% increase in online sales, as well as smoother international transactions and fewer chargeback issues.

Your Success Story Starts Here. Get Approved for Processing Today.

Alternatives to Head Shop Merchant Accounts

| Payment Method | Benefits | Risks | Best Use Case |

|---|---|---|---|

| ACH / Bank Transfer | Low cost, fewer chargebacks | Slower settlement | Subscriptions, repeat buyers |

| Cryptocurrency | Privacy, global reach | Volatility, adoption gap | Privacy-focused customers |

| BNPL (Buy Now Pay Later) | Higher sales, flexible payments | Regulatory oversight | High-ticket items (hookahs, glassware) |

Other payment methods are growing in popularity, even though the majority of head shops still process credit cards. Bank transfers, or ACH payments, are a cost-effective option that reduces transaction costs and chargeback risks for American retailers. ACH will be especially useful for companies that sell smoke accessories through subscription services.

Cryptocurrency payments are an additional choice that appeals to customers who are worried about their privacy. Accepting Bitcoin, Ethereum, or stablecoins like USDT can help you grow your clientele, especially in places where traditional banks are reluctant to take head shops.

A third trend that is altering the way payments are made is the rise of Buy Now, Pay Later (BNPL) services. For head shops that sell more costly items like hookahs, bongs, or fine glassware, these installment-based plans are a desirable alternative because they are particularly popular with younger customers. By integrating ACH, crypto, BNPL, and conventional cards with QuadraPay, merchants can provide customers with flexibility and reduce their reliance on conventional processors.

FAQs: Head Shop & Smoke Shop Merchant Accounts

What is the MCC for Head Shops?

The Merchant Category Code (MCC) is a four-digit number assigned by the Merchant acquirer to the underwritten business for categorizing the business according to the card brands. The MCC code clearly defines the category in which the Merchant falls based on the products or services sold. The Merchant classification code for head shops is MCC 5993.

Merchants classified with the MCC 5993 category code generally sell cigarettes, tobacco, electronic cigarettes, pipes, and smokers’ supplies. The subcategories of businesses that generally fall into this merchant category code include pipe shops, tobacco shops, and smoke shops.

Keep in mind that there are many other factors that a merchant account underwriter and the acquiring company will consider to categorize your business into a specific merchant category code. This includes the type of products that the Merchant is selling, as well as how the payment processor categorizes the Merchant. Therefore, it is important that merchants confirm their merchant classification code to ensure proper categorization.

Do you provide Credit Card Processing Services for physical head shop stores?

Absolutely! If you have a regular brick-and-mortar store where you sell head shop products, then we can certainly provide you with a high-quality credit card processing solution for card-present transactions. We offer highly advanced credit card terminals that easily integrate with your point-of-sale systems. You can either purchase these terminals with a one-time payment or rent them, depending on the country of your business registration. Our credit card terminal solutions may vary based on availability. Contact us today to learn more about retail credit card processing for head shops.

What are some good POS systems for smoke shops?

Some of the most popular POS systems for smoke shops include Quickvee, NRS Plus, Korona POS, MT POS Retail Cloud, and Acadia POS.

Can head shops get approved by mainstream processors like PayPal or Stripe?

Not very likely. Such payment processors often reject or freeze headshop accounts due to high-risk classification.

What payment options work best for head shops?

High-risk merchant accounts, ACH transfers, cryptocurrency, and Buy Now Pay Later (BNPL) options work best for head shops.

Future Trends in Head Shop Payment Processing

This year payment processing in the head shop industry has started showing drastic changes. Merchants have now started to use AI-powered fraud detection systems. These sophisticated tools flag questionable transactions before they become actual chargebacks. This is mainly done by continuously scanning thousands of data points 24/7. AI-driven monitoring is becoming a standard add-on offered by the best high-risk payment processors.

Another key development is the use of biometric verification for online payments. Modern payment gateways are using technologies like fingerprint scans, facial recognition, and even behavioral biometrics to more effectively confirm the identity of their customers. This thereby enhances the transaction security.

This not only helps merchants adhere to legal requirements but also boosts customer confidence. This system promises full transparency between all the parties involved in such transactions. Online Headshop businesses will be better positioned to expand internationally, maintain compliance, and deliver smooth checkout experiences that contemporary customers demand. Those who can swiftly adapt to these trends will have a major competitive advantage in the fast-paced, high-risk online paraphernalia industry.

Suggested Resources

https://www.grandviewresearch.com/industry-analysis/smoking-accessories-market-report

https://www.gminsights.com/industry-analysis/smoking-accessories-market

Stop Losing Sales. Apply for a Head Shop Merchant Account Now.”