Tech Support Merchant Accounts & Payment Solutions

Despite the exceptional growth potential of the industry, businesses offering IT services face one serious problem. They find it extremely hard to get a stable tech support merchant account. This is because of the prevalence of high fraud and chargebacks in this industry. Low-risk credit card processors outright decline the applications of tech support companies. Still, there are a few options that are open to IT services companies. The content team at QuadraPay has created this extensive guide to help you easily get approval for a merchant account. Let’s begin.

- Market Size: USD 73.1 billion (2025)

- Projected Market Size: USD 122.5 billion (2035)

- CAGR: 5.3%

- Top Growing Region: China, United States, Japan

- Online Transaction Growth YoY: Data not available

- Average Transaction Value: Data not available

- Key Growth Drivers: AI, Cloud Computing, Digital Transformation, Cybersecurity, Automation

- Leading Customer Segment: IT & Telecommunication Industry

- Tentative Global Online Business: Data not available

- Digital Payments Adoption Percentage: Data not available

- Top Market Opportunities: Subscription-based offerings, AI-driven support services

- Data Source: Fact.MR, Tech Support Services Market Outlook 2025 to 2035, 2024 Mordor Intelligence, Consumer Technical Support Services Market, 2024 Straits Research, Technical Support Outsourcing Market, 2022 Grand View Research, IT Services Market Report, 2024 Deloitte Technology Industry Outlook, 2025

What is a tech support merchant account?

A tech support merchant account is a specialized payment processing account designed for PC support companies. These accounts allow legit tech support companies to accept payments from customers for onetime and recurring IT support.

Tech Support Merchant Accounts Are High Risk

There are a variety of reasons why banks consider tech support as a high-risk industry; however, there are two main reasons.

High Chargebacks: PC support merchants, in general, attract high chargebacks. The chargeback ratio of any card merchant should not exceed 1%. If the merchant’s chargebacks exceed the limit, the processor shuts down the account.

Prevalent tech support scams: Over the years, numerous scams have happened in the tech support industry. This has led many credit card processing companies to develop the impression that the entire industry is fraudulent.

Other factors include recurring payment issues, complex service delivery, a high volume of international transactions, regulatory scrutiny, and a higher likelihood of account misuse or unethical practices.

Types of technical support merchant accounts

Domestic credit card processing for tech support: For tech companies in the US, a domestic card processing account is perfect. Local US processors and sponsor banks provide these solutions. For such accounts, merchants must have a favorable credit score and a fully US-owned company.

The use of offshore credit card processing for tech support is common. Most merchants find it challenging to get a domestic solution. For such merchants, there are various offshore payment gateways. Approval for these is slightly more straightforward. However, they may cost more and have delayed settlement options. The settlement period is generally 7 to 14 days. Sometimes the processor may also require the merchant to register a company in the country where the processor is located.

eCheck Payment Gateway for Tech Support. Many merchants may find it almost impossible to get credit card processing for tech support. Such merchants can opt for alternative merchant accounts. An eCheck payment gateway for tech support is one such option. For eCheck payments, customers do not have to use their credit cards. You can complete the transaction by simply entering the account number, routing number, and basic details. Compared to credit cards, eCheck transactions are significantly less expensive.

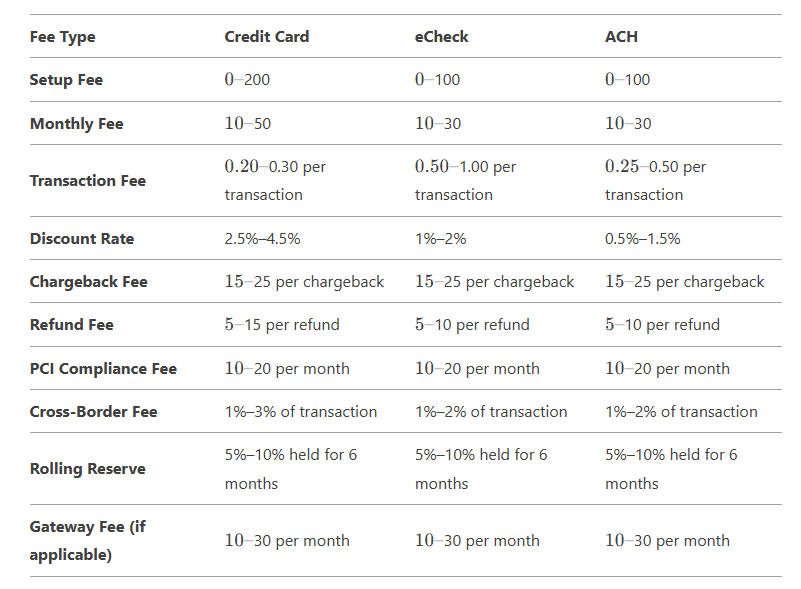

Fees for Tech Support Merchant Accounts

The processing fee is the most important factor to consider while choosing processors. The exact cost can vary depending on various factors, such as the volume of transactions and the risk profile. Here is a tentative fee structure for tech support merchant accounts:

*Discount Rate: Percentage charged on each transaction.

*Rolling Reserve: A percentage of transactions held by the processor to cover potential chargebacks.

*Cross-Border Fee: Applies to international transactions.

This structure is typical for tech support merchants, where other fees are common due to the high risk of chargebacks and fraud.

Timeframe for Approval of Tech Support Payment Gateway

The approval of a domestic account generally takes 3 to 7 business days. Offshore merchant accounts require a little bit longer. They generally take up to 10-15 business days. If you need a faster setup, then you may apply for an eCheck or ACH solution. Most of the time, you can receive these within 3–4 days. A payment processor that has experience working in the tech support industry can onboard accounts fast.

KYC Requirements for Tech Support Merchant Services

Know Your Customer (KYC) requirements are an important component of the merchant account application process. This is mandatory for any kind of merchant. Merchants must understand these requirements for smooth application approval.

Sponsor banks and payment processors require the full KYC set to approve the merchant account. These documents verify the identity of the business owners as well as confirm the genuineness of the business. Let us look at some of the key documents required in this process.

Business Registration Documents: Proof of company registration is vital. Without a registered company, the merchant cannot apply for a merchant account. This proof can be a copy of the company’s articles of incorporation, certificate of formation, or similar document. The types of businesses that can apply for a merchant account include LLCs, corporations, partnerships, sole proprietorships, and DBAs.

Bank Account Verification: The payment processor will hold the transaction funds for some time but is required to transfer them to the merchant’s business bank account. For this, the merchant must produce a confirmation letter that displays the bank account information. If a letter is not available, the merchant can also produce a voided check.

Address Verification: To confirm the physical address and the address of the directors, a utility bill is required. This document should be recent, usually within the last three months. It must show the name and address of the business or individual.

Personal Identification: The directors must provide government-issued photo identification such as a driver’s license or passport. This verifies the identity of the people behind the company.

Online Presence Verification: Tech support companies that wish to accept online payments must produce proof of domain registration. A receipt from the domain purchase or a document from the domain registrar can serve as proof of ownership. It is important to have a fully compliant website.

Website Compliance for Tech Support Merchant Accounts

Mandatory Disclaimers: Regarding No Brand Association and Availability of Warranty from Manufacturer. The merchant may offer support services for a device that falls under the original equipment manufacturer’s warranty. It is important for the merchant to clearly declare this information on the website, which informs the customer that a warranty or support may be available from the manufacturer.

No Brand Infringement: While a third-party tech support company may be providing assistance for a variety of products from different brands, it is important to have a clear disclaimer on the website that indicates that the merchant does not have any association with the brands listed on the website. It is also important to clearly define that the brands are owned by their respective owners.

Comprehensive Service Listings: The website must have clear descriptions of all the services available. It should include the pricing information, the scope of service, and any limitations or conditions associated with it. By giving this information, merchants reduce the risk of misunderstandings and potential disputes with customers.

Functional Shopping Cart: For the approval of an e-commerce merchant account for a tech support company, it is important for the merchant to have a fully functional shopping cart on the website. With the shopping cart, the customer can select the service, review their choices, and then proceed to checkout. The shopping cart clearly displays the selected quantity and the cost breakdown.

Payment Brand Logos: For the approval of a merchant account, the website must have the logos of the card brands. These logos clearly indicate that the merchant is readily accepting credit and debit cards from specific brands. The website’s footer section should list credit card brand logos.

Contact Information: For PC tech support companies, it is important to implement ways to reduce returns and chargebacks. By clearly displaying the contact information, which includes the company name, address, and 24/7 support number, merchants can effectively reduce disputes.

Policy Pages: Certain policy pages, including refund policy, privacy policy, terms and conditions, cookie policy, and GDPR policy, should be clearly written and must be easily accessible. These policy pages help set the right expectations in the minds of the customers.

SSL Certificate: For the approval of any type of merchant account, it is important to have all traffic securely transferred between all parties. For this, the merchant must have an active SSL certificate attached to the URL.

Clear Pricing: All products and services should have clear pricing. Display these in the appropriate currency. It is important to display any other costs, which include taxes and surcharges, before the customer reaches the checkout process.

Integration Process of Tech Support Merchant Account

After the account approval, the merchant initiates the integration process. A pro tip is that the merchant must ask the provider in the beginning of the application about integration options. This is because some website platforms are limited to integration with very few processors. So it’s always best to confirm if the merchant account is compatible with the merchant’s website. The merchant’s website can integrate the gateway using a variety of methods. Each has its own advantages and disadvantages; let us explore these options in detail.

Ready-Made Plugins: For merchants that use popular content management systems including WordPress, Magento, WooCommerce, OpenCart, and PrestaShop, most processors offer ready-to-use integration options and plugins. These plugins are easy to add.

HTML “Buy Now” Buttons: This is the simplest integration option, and it can be done without the need for any shopping cart. You can achieve integration by adding a simple HTML snippet. The problem with such an integration option is that for every product, the merchant has to do individual integrations. The merchant website directs the customers to a hosted payment page where they can enter their card details.

Disclaimer:

Merchant applicants must operate genuine, lawful, and fully compliant businesses. Any misrepresentation or engagement in prohibited, deceptive, or illegal activities may result in application denial or termination of merchant services. QuadraPay is a reseller/reffreal agent and not a payment processor.