Low-Risk Merchant Accounts: Insider’s Guide

What Is a Low-Risk Merchant Account?

A low-risk merchant account is a credit card processing solution for businesses operating in general industries. These merchants display minimum chargebacks and fraud instances. Every payment service provider considers low-risk merchants to be highly reliable. These merchants get preferential treatment such as affordable pricing, fast onboarding, quick settlements, and access to local as well as international card processing.

What is Merchant Risk in Payment Processing?

In the payment processing industry, merchant risk refers to various types of challenges that may be associated with merchants. Common risk types include credit risk, reputation risk, and transaction risk. The credit risk is generally evaluated by reviewing the financial strength of the applicant and the potential of refunds and chargebacks. The reputational risk is evaluated by understanding the overall social viewpoint about the merchant and their operating industry. The payment industry classifies merchants in low-, mid-, and high-risk categories.

Why Low-Risk Merchants Are Preferred by Payment Processors

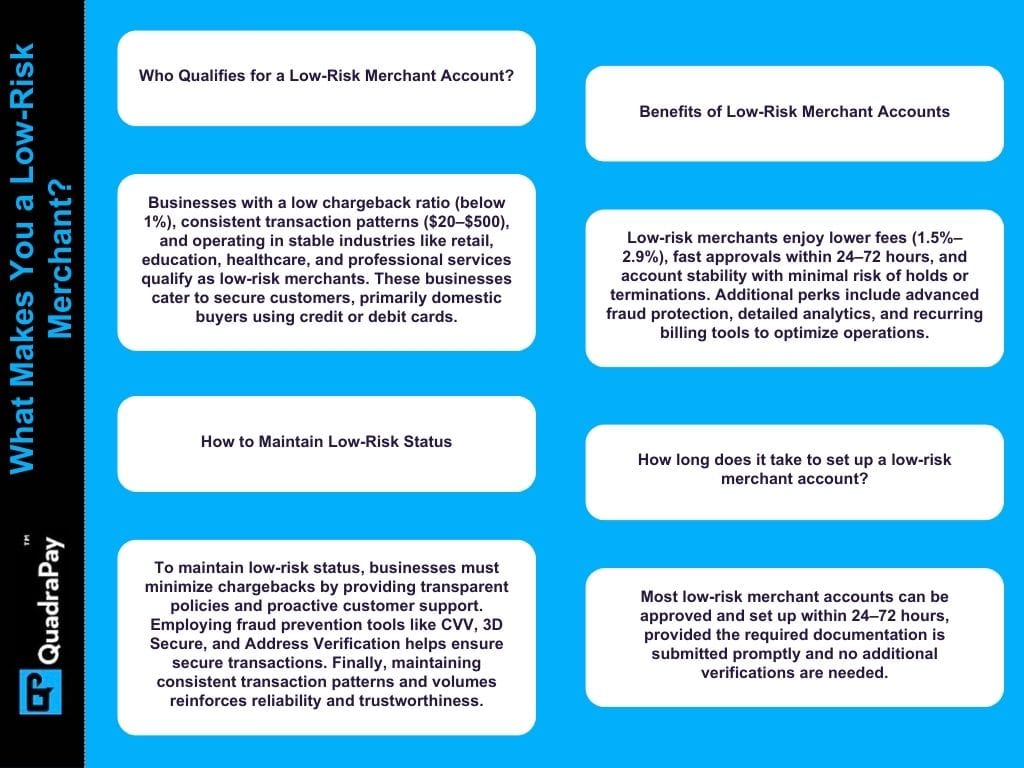

The risk profile of a merchant plays an important role in the success or failure of the merchant account application. Low-risk merchants are considered safe and stable. Payment processors usually do not hesitate to onboard such merchants. These accounts come with fast onboarding and require minimal documents. Once activated, low-risk merchant accounts stay active for a long period of time. Low-risk merchants hardly face payment holds or terminations.

On the contrary, if the merchant’s risk is high, then the onboarding is complex and can take time. High-risk merchant accounts are hard to manage and are generally not as stable as low-risk accounts.

Any merchant that wants to accept credit card payments must be aware of his risk classification. Being aware of the classification helps to prepare well and improve the chances of approval.

QuadraPay has been a reliable source of low-risk merchant accounts for businesses since 2016. Our team has written this guide and discussed various aspects of low-risk merchant accounts. We are confident that this guide will offer excellent benefits to you in your search for a low-risk merchant processor.

Let’s begin.

Features & Benefits of Low-Risk Merchant Accounts

Low Rates

When a payment service provider offers a low-risk merchant account, it attracts minimum risk. This is why they do not mind offering a reduced merchant discount rate. Most low-risk merchants qualify for minimum or nil monthly fees.

Fast Approval

Sponsor banks generally require less documentation and fewer background checks when they underwrite low-risk merchants, as these businesses have minimum financial and operational risk exposure. With quick setup, merchants can start accepting credit and debit card payments faster and avoid lengthy onboarding time.

Stable Account & Fewer Restrictions

Low-risk businesses generally do not face problems like sudden account freezing, payment holds, or terminations because the overall risk exposure is less. These accounts stay active for a long time. Merchants can generally process transactions without worrying about restrictive volume limits.

Multiple Payment Method

Low-risk merchants support card, ACH and e-check processing. Such accounts also support recurring billing. Merchants can customize the billing cycle for the customers; for example, they can accept monthly or annual transactions as per the agreement with the customer. Many low-risk merchant services companies provide digital tools that send notifications to customers about upcoming payments. Subscription payments help merchants reduce manual workforce requirements.

Detailed Analytics

Advanced analytics helps merchants gain insights into recent transactions and understand consumer behavior and sales trends. By carefully observing metrics like average transaction size and preferred payment methods, it can be easy for merchants to adjust their sales and pricing strategies. Some low-risk merchant services companies also offer customizable reports for tax filing and financial audit purposes.

Full PCI Compliance

Low-risk merchant services companies fully comply with the Payment Card Industry Data Security Standards. They provide full assistance to the merchants in a step-by-step manner so that the business meets the PCI requirements. Low-risk payment gateways use advanced features like tokenization and encryption. This helps to reduce the risk of fraud.

Better Support

Merchants get round-the-clock support. Most low-risk merchant services companies offer support via phone, email, and chat. Faster resolution of issues means minimum disruption of business operations.

Role of Low-Risk Merchant Processors

A low-risk merchant processor is the acquiring institution that offers low-risk merchant accounts. These payment processors design solutions that meet the processing needs of businesses operating in stable industries.

A low-risk merchant processor works as an intermediary between the merchant and its customers. The primary objective of the low-risk payment processor is to enable quick and safe credit card transactions. These processors allow merchants to accept one-time or recurring payments from their customers.

Their solutions are generally scalable and can adapt to the changing volume requirements of the merchant’s business. Most low-risk merchant processors offer easy integration to various payment gateways and content management systems.

Who Qualifies for a Low-Risk Merchant Account?

Merchants operating in a variety of industries can qualify for low-risk merchant accounts. Some of these industries include retail stores (whether physical or online) that sell household goods, clothing items, books, and electronics.

Businesses that offer professional services such as consulting, education, healthcare, and company formation. Certain subscription-based business models with stable revenue patterns may also qualify for low-risk merchant accounts, such as SaaS and CRM.

Choosing the Right Low-Risk Merchant Account Provider

For smooth operations, it is important for business owners to look for the right low-risk merchant account provider. While searching for the solution provider, merchants should look at various factors, including transaction fees, as they can directly impact business profit, especially if you process a high volume of payments each month.

Look for a low-risk merchant account provider that offers competitive pricing. Check how much the provider is charging for monthly fees, gateway fees, and setup costs.

Ask what payment methods they support. There is absolutely no harm in asking for a list of supported payment methods for local and international transactions. If you accept payments from customers across the world, make sure that you demand a list of supported currencies and what conversion charges will be applicable for transactions in different countries.