A multi-merchant credit card terminal is a device used by various businesses at the same location to accept credit card payments. This terminal differs from others. This is because multiple companies, businesses, and self-employed individuals share the same device to process credit card transactions. Instead of each merchant purchasing a separate terminal, they can use a single multi-merchant terminal while keeping their transactions and payments separate.

These terminals offer a fantastic customer experience by simplifying the checkout process. With this kind of terminal, customers can easily make credit card transactions at multiple businesses using a single device. This eliminates the unnecessary requirement for customers to visit various locations within the same business premises for payment processing. This saves customers time and effort and reduces the potential frustration associated with multiple transactions.

Features of Multi-Merchant Credit Card Terminals

Many features make a multi-merchant credit card terminal extremely attractive for businesses where separate entities operate under the same roof. Using a multi-merchant terminal can bring significant benefits to business owners.

Splitting the Initial Expense: Cost saving is the most important benefit of a multi-merchant terminal. This is primarily because it allows businesses to share the initial costs associated with the purchase and setup of the terminal. Instead of each business buying separate card processing terminals, all these businesses can pool funds to buy a single advanced terminal that supports all of them. This shared approach reduces the financial burden on each business.

Space Efficiency: In a small commercial spot where multiple businesses operate, allocating space for various credit card processing terminals becomes challenging. Multiple devices may require additional electrical wiring and furniture as well. Plus, more devices mean more accidental damage; you never know when a slight mistake by one of your customers will push the terminal to the ground. So it’s better to have one device than many. Helps you keep your desk clutter-free

Enhanced Reporting: These multi-merchant terminals come with an enhanced reporting system so you can extract details from the terminal at any time. A simple look at the daily transaction report can give an idea about the average ticket size and what products or services are selling more and bringing in more profit. These simple insights can bring exceptional motivation to small business owners.

Individual Merchant Identification: Although the terminal is the same for all merchants, each merchant can identify their transactions, ensuring that the collected funds are sent to the correct bank account without any confusion. The credit card processor implements a highly advanced TID coding system to make this possible. The card processing company can quickly identify which merchant has initiated the transaction.

Customization Options: Every business owner wants to build a brand, as it helps create a connection with the customer. With some advanced merchant terminals, individual artists and business owners can customize the receipt and add a few basic details.

Excellent Connectivity Options: Modern terminals have various connectivity options, including Ethernet, Wi-Fi, and mobile data, to ensure high-speed connectivity.

Touch-Free QR Code Payment with Multi-Merchant Terminals: Individual merchants can easily accept payments through various modes, including EMV chip cards, NFC payments, Apple Pay, and Google Pay.

Excellent Customer Support: QuadraPay offers these merchant terminals with the best payment providers in the US and the European Union; you can rest assured that you will get proper support.

FAQ: Multi-Merchant Credit Card Terminal Payment Processing

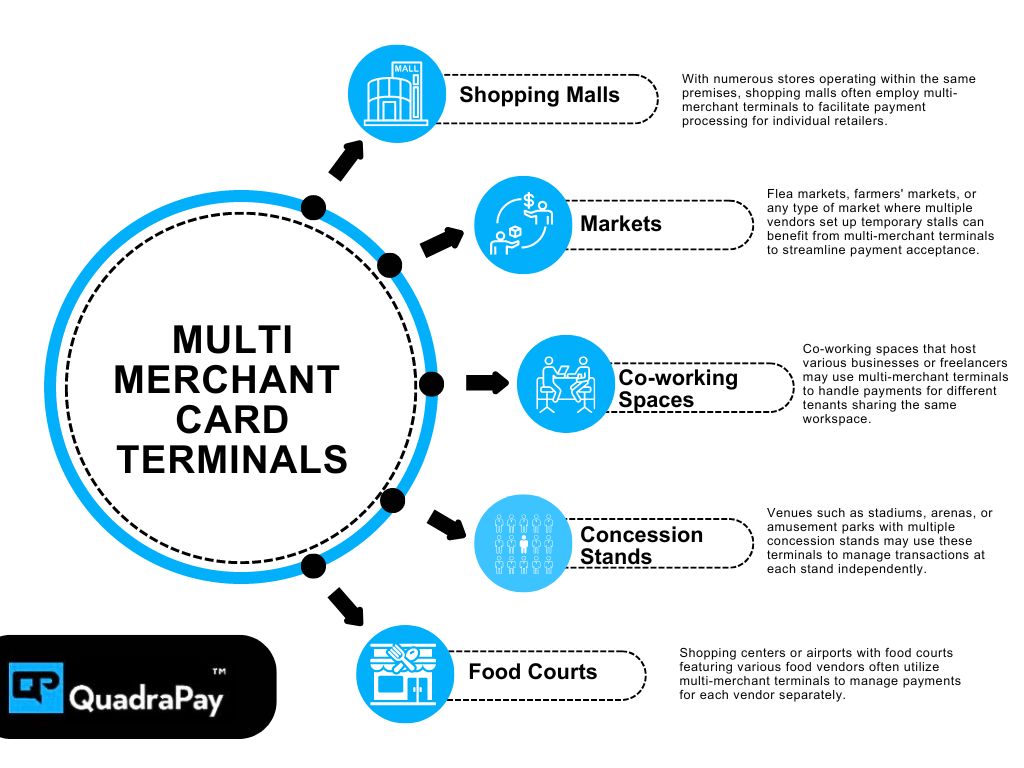

Which industries use multi-merchant terminals?

A multi-merchant terminal can be utilized by a business that has various sister companies all operating at the same location, and the parent company wishes to have separate merchant accounts for each strategic business unit. This may be for tax management, regulatory issues, or due to MCC conflicts.

An example of this would be a large real estate company that may also have a property management business, security company, and housekeeping company, all operating from the same office. A multi-merchant terminal helps a large real estate company manage payments efficiently. It ensures that payments for property management go directly to the property management company’s business account. Similarly, maintenance fees are routed to the maintenance company, keeping transactions organized and separate.

Other businesses that may use multi-merchant terminals are coworking spaces, gas stations, food courts, fitness centers, event spaces, tourist attractions, water parks, amusement parks, salons, barbershops, nail studios, spas, and similar businesses.

How Many Businesses Can Share a Single Multi-Merchant Credit Card Terminal?

The number of businesses that can share a single terminal depends on the specific terminal model and the capabilities of the payment processing system. In general, multi-merchant terminals are designed to cater to the needs of multiple businesses, typically ranging from a few to several dozen. The number of supported unique merchant identifiers, the payment terminal’s software configuration, and the terminal’s processing power are just a few examples of the variables that can affect the terminal’s capacity.

Some terminals may have a fixed limit on the number of businesses that can be added, while others may offer highly scalable options that can accommodate a greater number of companies as needed. It is important to note that the exact number of businesses that can share a payment terminal will depend on the specifications and capabilities of the hardware, as well as the service capabilities of the payment processor and any limitations imposed by various card processing regulation bodies. You can contact QuadraPay today for a free consultation about how QuadraPay can help you secure a multi-merchant terminal.

How Are Transactions Initiated At A Multi-Merchant Terminal?

The seller uses a unique identifier and processes the transaction. This simple process ensures that the transaction is added to the merchant account of that specific business owner, and the funds are moved to the respective bank account.

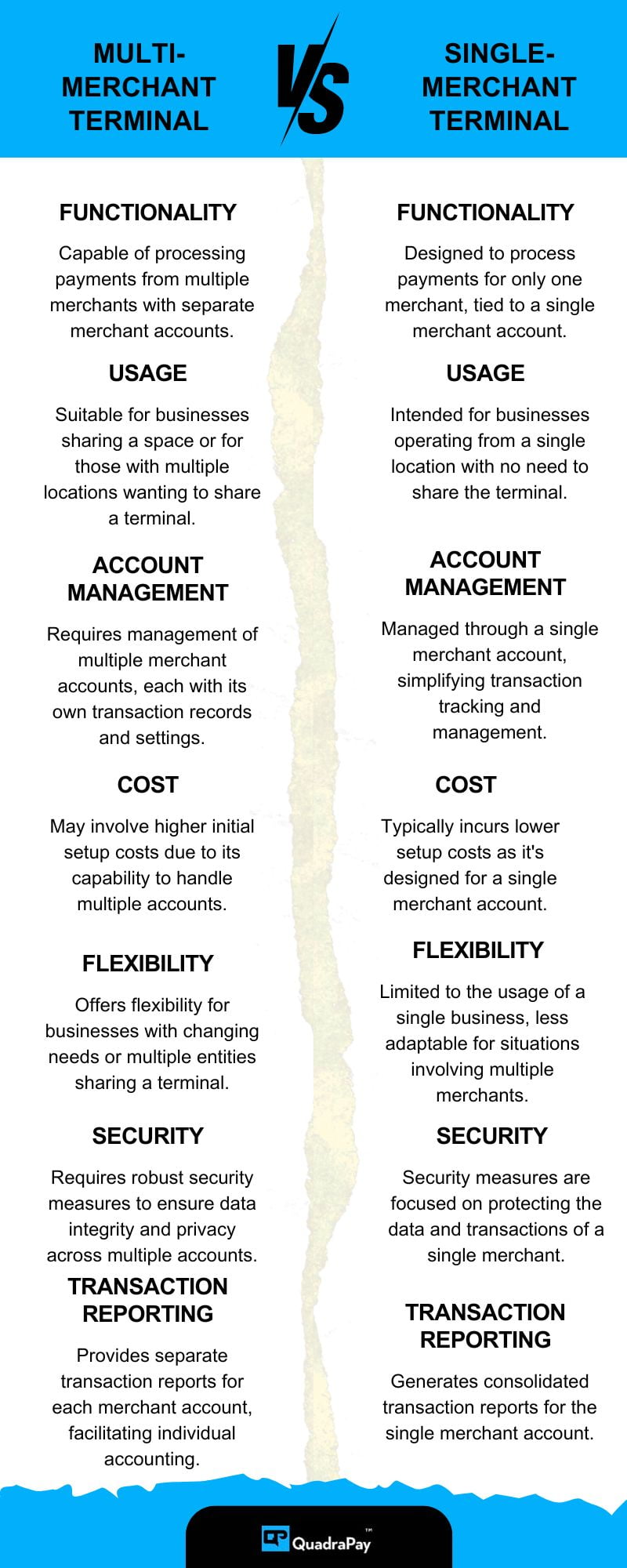

Are Multi-Merchant Terminals More Expensive Than Traditional Card Terminals?

The cost of a multi-merchant terminal compared to a traditional card processing terminal can vary depending on several factors. In many cases, a multi-merchant terminal can be slightly more expensive due to the advanced features and the various individual businesses it supports. Businesses should focus on the long-term benefits of multi-merchant terminals, as they help save money over time. These terminals also come with great functionalities, including the ability to add and remove users without any significant expense.

What Are The Top Multi Merchant Terminals In High Demand In America?

Two of the most popular multi-merchant terminals in high demand across America are the Dejavú P1 and Dejavú QD4. These terminals utilize the MMSx system to generate Terminal Profile Numbers (TPNs) for multiple Merchant IDs (MIDs) within the same Dejavoo Magic terminal. The process of activating these terminals is easily understandable by reading the user manual. After adding the appropriate parameters, these terminals request host merchant-specific information, such as headers, trailers, and devices. Once configured, they operate efficiently.