High-Risk Merchant Accounts in Canada: A Complete Guide

Many high-risk businesses in Canada face difficulties in obtaining approval for merchant accounts. Most low-risk acquirers impose strict requirements, making the process challenging. Some businesses are fortunate to secure a solution after applying to multiple providers, while others struggle to find any provider willing to approve them. These businesses, despite being legal, face survival challenges.

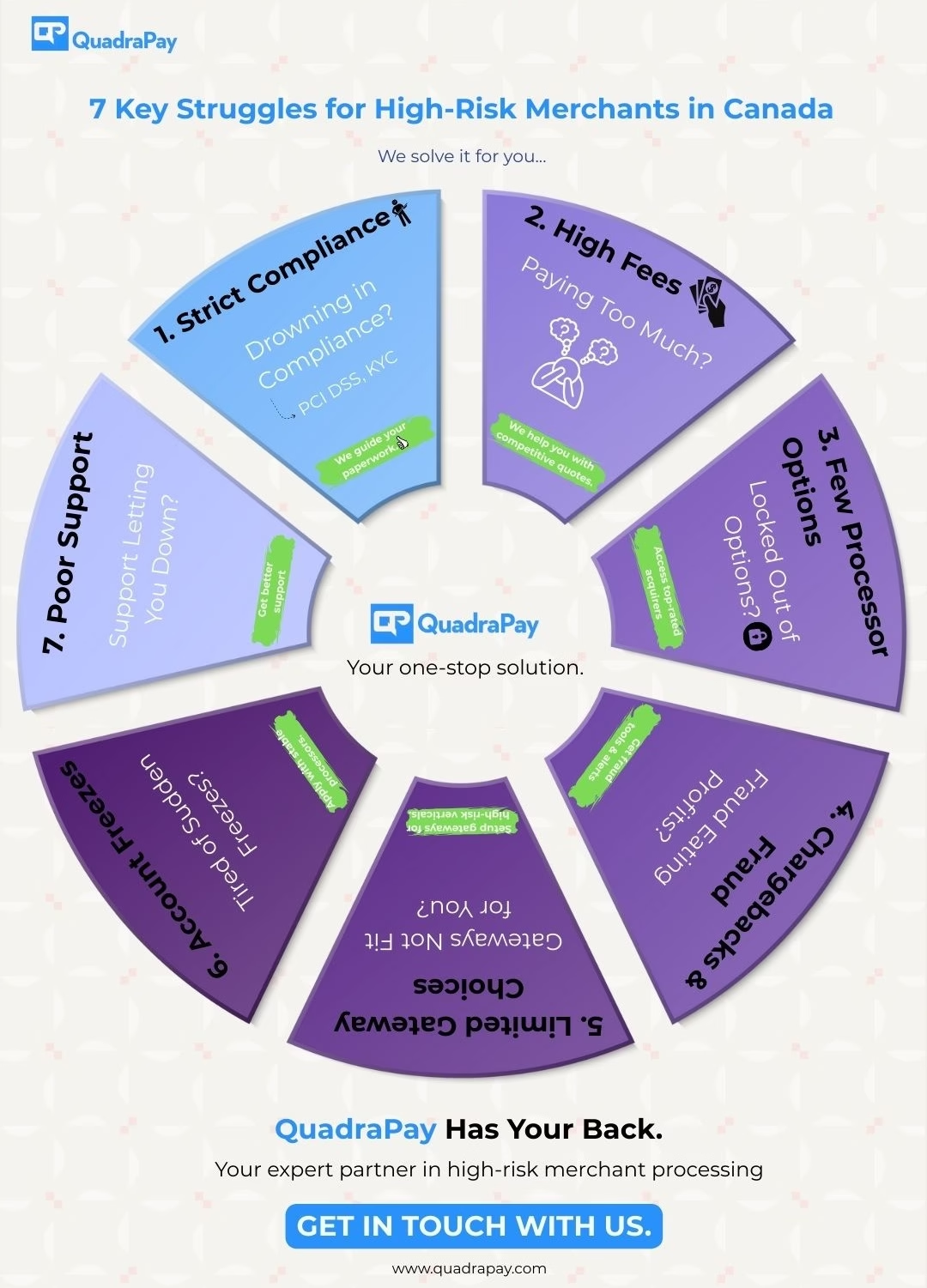

Here are the seven key challenges that Canadian high-risk merchants frequently face:

| Challenge | Description |

|---|---|

| Strict Compliance | Meeting PCI DSS and KYC requirements can be time-consuming and complex. |

| High Fees | Elevated transaction and processing costs reduce overall profitability. |

| Few Options | It’s often difficult to find processors willing to support high-risk verticals. |

| Chargebacks & Fraud | Higher risk of disputes and fraudulent activity leads to penalties and account instability. |

| Limited Gateways | Fewer gateway options, with many offering limited functionality for high-risk businesses. |

| Account Freezes | Unexpected freezes or terminations can disrupt business operations and cash flow. |

| Poor Support | Unreliable or slow customer support delays issue resolution and onboarding. |

At QuadraPay, we understand these pain points. This is why our content team has written this cheat sheet. This industry guide explores everything about high-risk merchant accounts in Canada. We are confident that this guide will help you understand ways to remove the obstacles that may arise in your quest to get a merchant account. You can listen to the audio version or watch the video version of this cheat sheet on our social media handles. Let’s begin.

What is a high-risk merchant account in Canada?

A high-risk merchant account in Canada is a specialized bank account for businesses classified as high-risk by banks. It allows them to accept credit card payments. These accounts function like regular merchant accounts but come with key differences. Underwriting is stricter, rates are slightly higher, and proactive monitoring is required. Certain restrictions apply based on the industry and the merchant’s risk profile.

Apply for high-risk processing in multiple countries

Why are some merchants considered high risk in Canada?

Banking institutions have their style of operations. They choose which industries to work in and which to avoid. Every bank has its own risk appetite. Certain industries are legal but are considered high-risk. In Canada, specialized high-risk processors cater to merchants from high-risk industries.

Below are the key reasons why Canadian businesses are often labelled as high risk by acquiring banks and payment processors:

| Risk Factor | Description |

|---|---|

| Industry Reputation | Some industries (e.g., adult, CBD, gaming) carry reputational risks. |

| High Chargebacks | Businesses with a chargeback rate over 1% are considered high risk by most acquirers. |

| Legal Restrictions | Certain sectors may be legal but face heavy provincial or federal regulations. |

| High Ticket Size | Industries with high transaction values (e.g., coaching, jewellery, forex) carry more risk for banks. |

| Recurring Billing | Subscription-based models are prone to disputes and cancellations, which increases chargeback risk. |

| Cross-Border Transactions | Businesses selling internationally face higher fraud risk and currency challenges. |

| Lack of Processing History | Startups and unproven merchants without a track record are often viewed as riskier. |

A few of the key reasons that make a Canadian business high risk include the reputation of the industry, the risk of chargebacks, and regulatory challenges. Now let’s explore various such reasons in detail.

Industry

Certain industries are globally classified as high-risk. These merchants can get card processing solutions after strict evaluation. They may also need to complete a mandatory high-risk registration. Every high-risk industry has some challenges associated with credit and reputational risk. The list below includes some examples.

Antiques & Collectibles businesses sell items that can attract frequent disputes. These disputes may arise due to pricing, item conditions, and questions about authenticity. Customers may feel they paid more than the product was worth, increasing the risk of chargebacks. This industry is also infamous because of fraudulent buyers. Sometimes fraudsters use stolen credit cards to purchase high-value antique items. All this makes Canadian antiques and collectible businesses high risk for acquiring banks.

The clothing business may look like a very secure industry, but in reality, it involves a lot of risk for acquirers. Recently, the apparel industry has started seeing high rates of returns and exchanges. Occasionally, such returns may be due to issues with sizes or colours. These issues contribute to the merchant’s financial instability. Any boutique that sees the seasonal spike in sales can create fluctuating cash flow. These conditions can lead to higher credit risk for the acquiring bank when customers start asking for refunds.

The challenge faced by cannabis and hemp-related businesses is their legal status. It varies across regions. Some jurisdictions allow such businesses with restrictions, whereas others prohibit them. The challenge for these merchants increases when they encounter difficulties in obtaining a merchant account. Processors believe cannabis-related businesses face regulatory challenges. Such situations can result in inconsistent banking relations because of federal or provincial laws.

CBD products are widely available in Canada. Every Canadian CBD entrepreneur is aware of the legal uncertainties surrounding this industry. The industry may be legal but is highly regulated, and restrictions do apply. The complex structure makes it difficult for processors to support CBD oil merchants.

Similar to industries such as CBD, the gambling industry also faces significant challenges due to the varying legal landscapes. Furthermore, gambling merchants generally deal with large sums of money, which can make them a potential target of fraud. Gambling is regulated in most jurisdictions. Payment service providers that support this industry must know the regulations for the merchant’s home location and the location where they expect traffic from.

High Chargeback

If a merchant gets above the normal chargebacks, then that merchant becomes a liability for the processor. It is important for businesses to ensure that the chargeback ratio always stays under 1%. They can take several steps to keep chargebacks below the threshold.

High Ticket Size

Certain industries have more than average ticket size. Their monthly sales volume is multiple times that of merchants from low-risk industries. Some examples include gaming, gambling, exports/imports, B2B, jewellery, coaching, seminars, crypto trading, forex trading, and betting advice merchants. All these industries are naturally high risk because of the ticket size and high monthly sales volume.

Chargeback Prevention Strategies for Canadian High-Risk E-commerce Merchants

| Strategy | Description |

|---|---|

| Clear Refund Policy | Clearly state refund timelines, conditions, and eligibility to reduce disputes. |

| Fraud Detection Tools | Use AI-based fraud detection, address verification (AVS), and CVV checks. |

| Real-Time Order Confirmation | Send instant email/SMS confirmations with order details and tracking info. |

| Customer Support Availability | 24/7 support helps resolve disputes before they escalate into chargebacks. |

| Chargeback Alerts & Prevention | Enroll in chargeback alert services like Ethoca & Verifi to resolve issues early. |

| Recurring Billing Transparency | Notify customers before subscription renewals & offer easy cancellation. |

| Detailed Product Descriptions | Avoid misrepresentation by providing accurate images, specs, and terms. |

| Delivery & Tracking System | Use reliable shipping with tracking and proof of delivery to prevent disputes. |

| Transaction Descriptors | Use recognizable billing descriptors to prevent confusion and “friendly fraud.” |

| Customer Dispute Education | Educate customers on proper dispute resolution channels instead of chargebacks. |

Features of high-risk credit card processing accounts in Canada

It is important for Canadian businesses to consider several factors when selecting a high-risk merchant processor. We have listed some of these factors here:

High-Risk PSP: Not every payment processor works with high-risk merchants. Some high-risk merchants in select industries can only be onboarded by specialized payment processors. In the payment industry, these processors are also known as high-risk processors.

Experience: It is important to ensure that the payment processor has enough experience assisting merchants from the region. A seasoned high-risk payment facilitator operating in Canada or the USA may be a viable option.

Multiple Payment Methods: Merchants should prefer a provider that allows them to accept various payment methods. By adding multiple payment methods to the checkout page, merchants increase the chances of transaction success.

Affordability: Pricing should be reasonable. As an informed merchant, you should be aware that in the payment industry, pricing comes in different types: fixed pricing and interchange pricing. A little bit of research on these pricing models can help merchants negotiate better deals.

Fast Settlement Cycle: Most high-risk payment processors in Canada offer a rapid settlement cycle. This process helps ensure better business operations because of healthy cash flow.

Easy Integration: Integration with your website or platform must be straightforward. Your payment processor should provide ready-to-use plugins for popular content management platforms in Canada, like Shopify, Wix, BigCommerce, etc. The payment processor should also provide detailed API information for custom integration.

Advanced Merchant Panel: The merchant panel should be easy to use. It should have functions for exporting records and uploading chargeback representment documents.

KYC for High-Risk Merchant Accounts in Canada

To get a high-risk credit card processing account for your business in Canada, you must submit certain KYC documents. Let’s look at some of the documents that you will have to send to the provider:

| Document Type | Description |

|---|---|

| Business Registration | Proof of incorporation or registration in Canada |

| ID Proof | Government-issued ID (passport, driver’s license) |

| Address Proof | Recent utility bill showing business or owner’s address |

| Processing History | Last 3–6 months of credit card processing statements |

| Bank Statements | Latest 3 months of business account statements |

The business registration certificate, AOA, and MOA are required to verify the business entity. Merchants with any of the following business structures can apply for an account: sole proprietorship, partnership, limited partnership (LP), corporation, limited liability partnership (LLP), not-for-profit organization, and trust.

For identification purposes, you can send a copy of your national ID, passport, or driver’s license.

To confirm the company’s physical address, utility bills are required. This can be a telephone, gas, or electricity bill.

To further assess your business’s financial stability, statements from the past three months of your business bank account are required. This financial documentation provides insights into your business’s cash flow and financial health.

Your previous statements for credit card processing play a positive role in getting your account approved. High-risk acquiring banks prefer to work with businesses that already have experience accepting credit card payments.

Application Process for High-Risk Payment Processing Account in Canada

The application process is simple. You start with research and apply to a few select providers. However, this process can be time-consuming. With QuadraPay, you can save a lot of time, as we have already established contacts with well-known high-risk processors. We are a reseller, and our service allows you to negotiate directly with processors. If you choose our recommended solution, then we may receive a commission. You can consider it a reward for all the legwork we put in to get you approved.

When you contact us, we will check your website to confirm whether our processing partners will review it or not. Our high-risk payment processing partners will check your website and KYC documents. Once approved, our partner processor will send you a contract. After signing the contract, you can proceed with integration and start accepting real-time transactions on your website or mobile applications.

FAQ: High-Risk Credit Card Processing in Canada

What role does QuadraPay play?

QuadraPay acts as a reseller. We do not process payments ourselves and are not responsible for the payment processing services provided by these third-party entities. We are not a payment processing company. We connect merchants with leading payment processors. All payment processing services are provided directly by third-party processors, and we are not responsible for their terms, policies, or services.

What strategies can Canadian merchants implement to reduce the risk of account shutdown?

Merchants can implement several strategies to reduce the risk of account shutdown. We suggest you should work with a reliable high-risk merchant account processor. This way you know that your provider is stable. Every high-risk merchant should use some kind of order verification process to reduce fraudulent transactions. This can be easily done if you have a competent customer care team.

What Is the Future of High-Risk Payment Processing in Canada?

In the coming years, the Canadian high-risk merchant processing industry may see better acceptance of cryptocurrencies. Merchants will be more comfortable paying high-risk merchant registration fees.

What Is the Approval Timeline for a High-Risk Payment Gateway in Canada?

Many factors influence the approval timeframe; however, most accounts are approved in a week’s time. It’s important to apply strategically rather than sending applications to all banks and payment service providers, as this approach may delay approvals and create an unfavourable impression.

Below is a general breakdown of the high-risk merchant account approval timeline in Canada:

| Stage | Timeframe | Details |

|---|---|---|

| Application Submission | 1–2 Days | Fill out an application with your business details, transaction history, and financials. |

| Underwriting Review | 3–5 Days | The payment processor evaluates risk factors like business model, chargebacks, and compliance. |

| Account Setup | 1–2 Days | Once approved, the provider configures and sets up your merchant account. |

| Go Live | 1 Week (Total) | Your account is activated. You can start accepting payments immediately. |

How Do Regulations Differ Across Canadian Provinces, and What Can Merchants Do About It?

Yes, regulations vary across Canadian provinces. For instance, in Ontario, online gaming merchants must follow the regulations of iGaming Ontario. Quebec has strict language requirements for e-commerce websites. British Columbia has specific rules for CBD and cannabis-related businesses. Alberta has unique regulations for payday loan companies. When searching for a high-risk merchant account, consider processors familiar with your region. Each area may have unique challenges and opportunities for high-risk businesses.

It’s important to note that while federal regulations apply across Canada, provincial laws can significantly impact how high-risk businesses operate. For example, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) oversees anti-money laundering efforts nationwide, but provincial securities commissions may have additional requirements for forex and cryptocurrency businesses.

Industry Resources:

https://www.globaldata.com/store/report/canada-cards-and-payments-market-analysis/