High-Risk eCheck Processing: Insiders Guide

Millions of American consumers do not have access to well-known credit cards. However, a large percentage of these consumers have access to bank accounts. Now e-commerce merchants can tap into this huge market by using echeck processing as a payment method. Merchants from various high-risk industries can also use specialized high risk echeck processing accounts and accept payments from their customers.

The team at QuadraPay understands the pain points of high risk merchants and that is why we have created this extensive guide that explores high risk echeck processing in detail. Let’s begin.

Understanding High-Risk eCheck Processing

What is an eCheck?

eCheck is the digital form of a regular paper check. It holds the same value as a traditional paper check. These transactions happen quickly in comparison to traditional check processing as they go through the Automated Clearing House network(ACH). To initiate an eCheck transaction, customers submit the account number and routing number on the checkout page. The funds move electronically from the customer’s account to the merchant’s account.

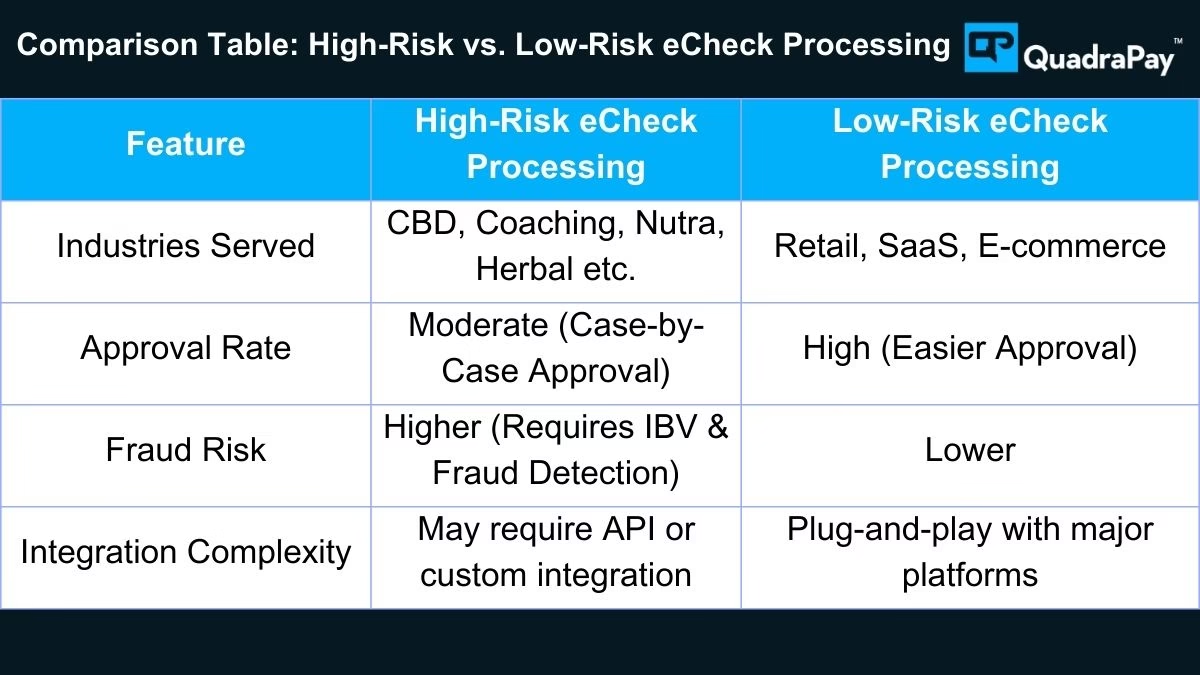

There are a few key differences between regular eCheck processing and high-risk eCheck processing. The technology behind both stays the same; the difference is mostly based on what type of merchant uses the solution. While a regular eCheck payment gateway is fit for eCommerce and similar businesses, on the other hand, high-risk eCheck processing is for merchants in hard-to-place industries such as gaming, CBD, forex, crypto, etc.

High-risk eCheck payment gateways are popular among merchants that face high chargebacks. As we know, credit card processors don’t allow over 1% chargebacks for merchants that can’t manage the ratio for them; only high-risk eCheck processing is an option.

How High-Risk eCheck Processing Works:

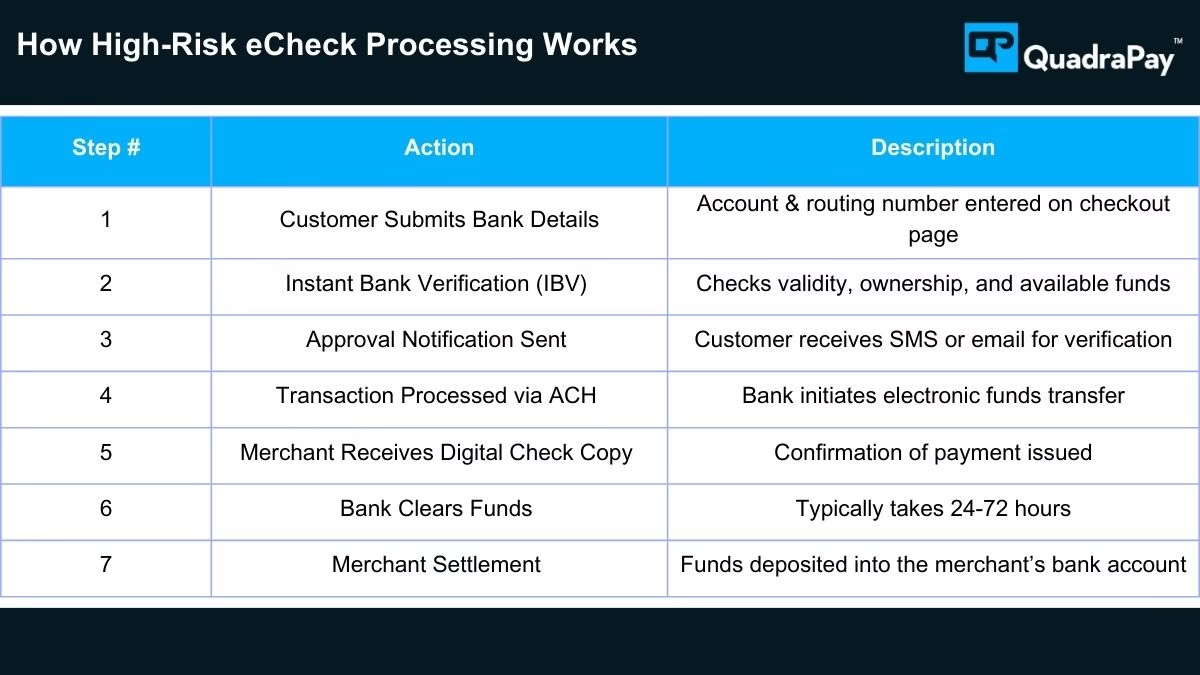

The high-risk eCheck payment gateway is generally used by merchants that cannot get any credit card processing solution. With the eCheck payment gateway, the customer makes the payment directly from the bank account by simply filling in a few details on the merchant website. To reduce the risk of bad checks, these specialized high-risk e-check processing companies use a tool called instant bank verification(IBV). With IBV eCheck processors, confirm the customer’s bank account details in real-time.

The check verification process with IBV starts immediately at the time when the customer submits the account and routing number. IBV checks various parameters, including the validity of the account and account ownership validation, and also checks if there are sufficient funds to clear the transaction. All this happens in just a few seconds.

After the verification, the payment gateway sends a notification to the customer. This can be in the form of SMS or email. Once the customer verifies the approval email/SMS, a digital copy of the check is sent to the merchant, and the customer gets a copy of the payment receipt.

In the next step, the merchant scans the paper check and uploads the soft copy on the merchant’s bank mobile app. The transaction is then pushed to the ACH network for final clearing. Customers Bank verifies the request, and if everything goes well, approves the transaction and sends the money to the merchant’s business bank account. This entire process takes 24 to 72 hours.

High-Risk eCheck Payment Gateway Fees

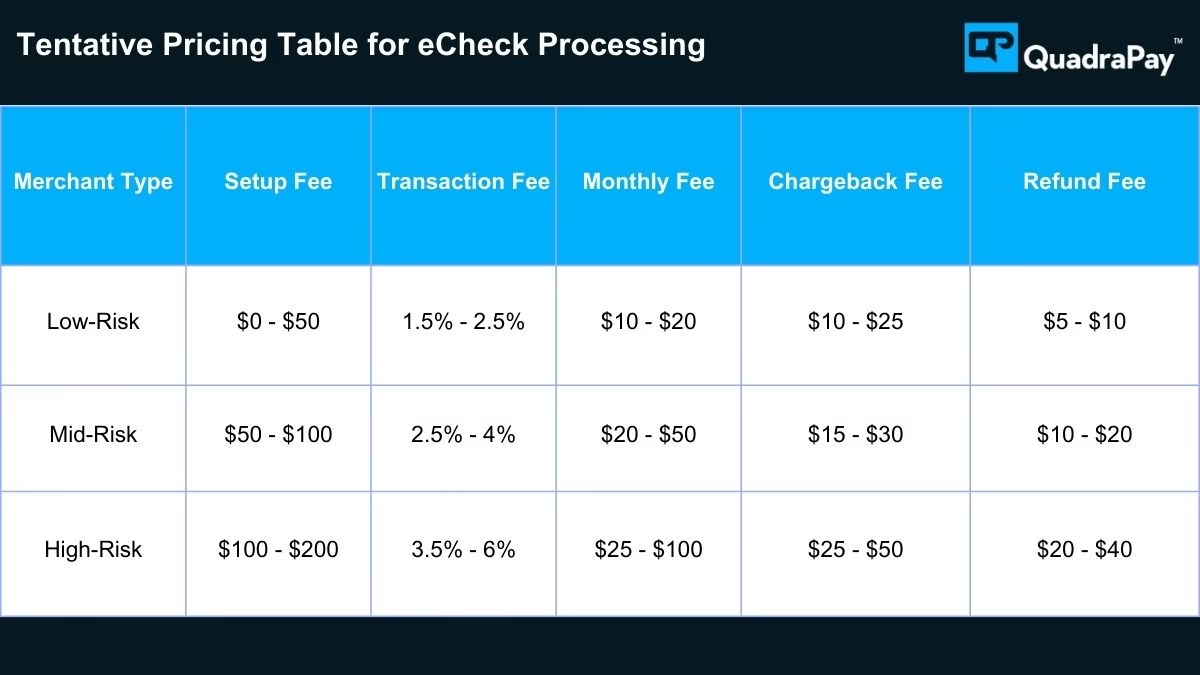

Pricing plays an important role when choosing any payment gateway solution including a high risk echeck payment gateway. The provider must offer a transparent terms sheet that clearly displays all the possible fees that the merchant may have to pay for using the account. echeck payment processing is comparatively cheaper than credit card processing and it helps merchants save a lot of money.

The exact pricing can only be given after carefully observing the merchants risk profile and the committed volume, however here in this table you can find the tentative pricing for low risk and high risk echeck payment processing accounts.

Features of High-Risk eCheck Processing

There are various features that make high-risk eCheck payment gateways an attractive choice for all kinds of merchants. Let us explore some of the most important features of the solution.

One-time and recurring payment processing: Most credit card processing companies hate subscription payments. Fortunately, the electronic check payment gateway comes with a recurring payment facility. This means that the payment gateway sends a debit request to the customer’s account as per the approved schedule this can be monthly, quarterly or yearly.It is an extremely beneficial feature for merchants in the service sectors, such as insurance, loans, timeshare, debt collection, etc.

Supports high-volume transactions: The average ticket size of merchants varies based on industries. For those merchants that require a payment instrument that allows them to accept high-volume transactions, eCheck can be a wonderful option. While a credit card processor may only allow merchants to process transactions in three figures, with echeck merchants can easily process four figure transactions.

Faster settlement times compared to paper checks: Traditional check processing used to take a lot of time to clear; in general, they used to take anything between 5 to 10 business days. But now with electronic checks, they can clear within 24 to 72 hours in most cases. This feature of the electronics check solution makes it a popular choice among e-commerce merchants.

Reduced risk of bounced checks: Return used to be a big problem with paper checks; however, it’s not the case with electronic checks. The instant bank verification feature immediately verifies the mandatory details, which reduces the risk of submitting invalid checks. Merchants that use electronic checks definitely get better protection against check bounce, and NSF.

All the features listed above make echecks one of the best payment processing solutions for hard-to-place merchants. While this may not be the most convenient way of accepting payment from your customer it can at least be a lifeline for millions of those merchants who get struggle to find approval from credit card processors. In the next action, we will look at the ways to accept electronic check payment.

Four Ways to Accept eCheck Payments

With our high risk echeck payment processing solution merchants can accept transactions in four ways. Let us explore these.

Face-to-Face eCheck Payments: This payment mode is beneficial for in-store payments where the merchant collects the account number and routing number from the customer and submits it to the virtual terminal. Merchants can also put up an e-check kiosk at the retail store where the customer can submit the details himself. This type of eCheck payment mode can be extremely beneficial for industries like trade shows, consulting services, HVAC, freelancers, contractors, wholesale, equipment rental, and event management.

Web-Based eCheck Payment Option: The solution also comes with an API integration option, which allows merchants to connect the payment gateway directly to the business website. This way, customers can visit the merchant’s website and submit the account information to process the transaction. Most of our partner providers offer ready-to-use plugins for content management systems such as WooCommerce, Magento, and Joomla.

Pay by eCheck over Email: Another payment mode is email based invoice payments. In this mode, the merchant sends an email to the customers with the link to the checkout page. The customer opens the email, clicks on the links, and submits the account details on a secure payment page.

eCheck by Phone: For call centres that wish to accept payments by electronic check they can use the virtual terminal. This way, customers can share the account details, and the representative can submit the information on to the virtual terminal. It is important to remember that accepting each transaction over the phone involves additional risk and should be avoided at all cost.

Industries that need high-risk eCheck processing

Merchants from all industries that are considered high risk by credit card processors can definitely explore eCheck payment processing. However, for some industries, this solution works like a charm. We have listed a few of these below for your understanding.

Nutraceuticals and CBD: The regulatory landscape surrounding nutraceuticals and CBD products is complex, and that is why many payment service providers simply avoid working with these merchants. There may be many reasons behind this negative impression, but the most critical reason is the risk of high chargebacks. As credit card processors do not like working with CBD and nutraceutical merchants, these businesses can start using eCheck.

Debt collection agencies: E-check is a popular payment instrument used by debt collection companies. Most of the debtors have bad credit scores, and that is why they don’t have access to regular credit cards. High risk echeck processing solution is best for collection companies, as debtors can easily make payments from their bank accounts without requiring any line of credit.

Coaching & Seminars: Business coaches and seminar organizers can also use echeck as the primary payment instrument; this is because the ticket size in the coaching and seminar industry is generally very high.

Other industries that can use eCheck payment gateways include parking, B2B,toll management, car rentals, auto financing; chiropractors, alternative medicine providers, and high-ticket wellness services.

Application Process for High-Risk eCheck Processing

The application process to get a high-risk eCheck payment gateway starts by collecting the required KYC documents. These are important business documents that the merchant must provide to the payment processor. along with the KYC document The merchant also needs to provide the application form for a field merchant account. Keep in mind that the KYC documents needed for each payment gateway are generally less than what a merchant would provide to a credit card processor. This is because the checks hit directly into the merchant’s bank account, and each payment gateway company only provides a software infrastructure to create the digital copies of the paper check.

Common KYC documents include the business licence, photo id of the director, financial statement of the company, list of URL where the payment will be processed, and copy of refund policy.

FAQ High risk eCheck processing

Q: How does eCheck work on WordPress and WooCommerce sites?

Aur electronic check payment processing solutions come with a readymade plugin that can be easily integrated to wordpress and who commits websites. Along with that for merchants that need custom integration they get API documents which can help in writing custom codes.

Future Trends in High-Risk eCheck Payment Processing

The demand for electronic check payment gateways will increase, especially in high-risk industries. This is because credit card processors are becoming stripped for various mid-risk industries as well. Saying that, in the coming years, eCheck will get new features that will make the solution a lot better than what the conventional credit card processing solution looks like today.

Final Words: Use Better eCheck Processing for Business Growth

If you are struggling to get a credit card processing account and every processor is saying no to you, it’s probably the right time for you to find a check payment gateway for your business. How a check payment gateway can help your business today for a zero-obligation code

Industry Resources

1. Phixius by NACHA

2. Automated Clearing House Activities: Risk Management Guidance