Stable Telemarketing Merchant Accounts By QuadraPay

A telemarketing merchant account is a credit card processing solution designed specifically for companies engaged in telemarketing activities. This payment processing solution helps these businesses accept credit and debit card payments over the phone. These telemarketing merchant accounts come with features like IVR payment, invoice payments, and virtual terminals. This type of merchant account is generally used for card-not-present (CNP) transactions.

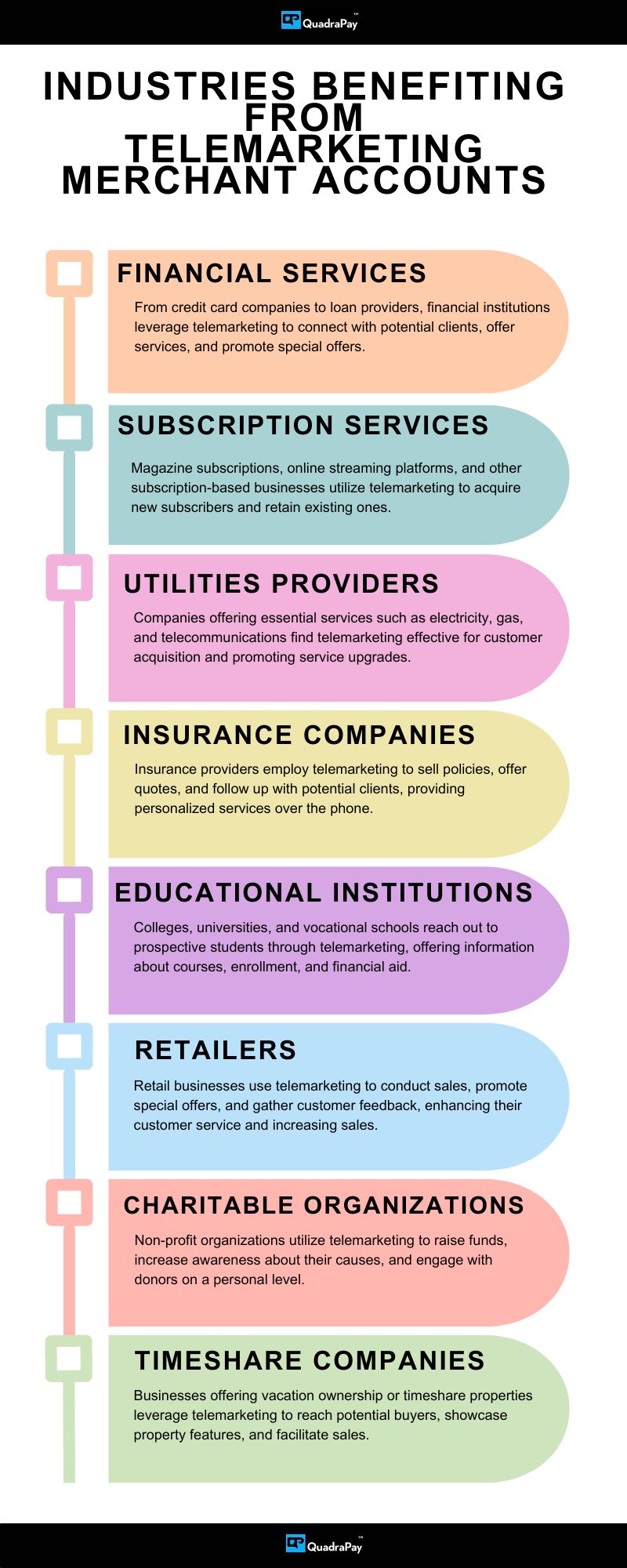

Telemarketing merchant accounts are generally used by companies that operate on the business-to-consumer model. Businesses utilize these solutions for generating fresh sales, renewing orders, upselling, and cross-selling. Some industries that regularly use this type of payment processing solution include marketing agencies, utility companies, subscription services, financial services, insurance, charitable organizations, timeshare properties, colleges, universities, and vocational schools, to name a few.

Payment Processors Consider Telemarketing Merchant Accounts To Be High Risk.

A telemarketing merchant account is generally considered high risk by acquiring banks and payment service providers. There are various reasons that influence the viewpoint of these merchant processing industries about telemarketing merchant services. Let’s explore a few of these reasons.

Telemarketing companies conduct transactions over the phone, which are considered card-not-present transactions and are therefore at a higher risk of chargeback. Customers can dispute the transaction and request a refund for many reasons, including not properly understanding the offer, receiving incorrect information from the representative, or feeling that the representative used deceptive sales tactics.

The telemarketing industry is subject to various regulations and laws, especially regarding the protection of consumer rights. The Telephone Consumer Protection Act (TCPA) in the United States is one such law that telemarketing companies must adhere to without delay. Alongside TCPA, there are many other regulations that telemarketing companies must comply with. Failing to do so can attract challenges for both the payment processor and the merchant. This complexity often discourages many payment processors, leading them to steer clear of telemarketing merchants.

The potential for fraud in telemarketing transactions is higher than in many other industries. Alongside that, challenges such as identity theft or unauthorized use of customers’ credit cards by telecallers can cause additional problems for the payment processor. Additionally, the industry is subject to high scrutiny and has a negative perception due to unethical sales tactics and aggressive marketing. This creates reputational risk for the payment processor.

Stay compliant with expert high-risk support

Application Process for High Risk Telemarketing Merchant Services with QuadraPay

To apply for a high-risk telemarketing merchant services account, we request you to fill out the basic form on our website. On the form, you will only need to submit a few pieces of information such as your email address, name, phone number, and a message. Please apply using your business email ID. Once we receive this information, we will connect with you to discuss your unique requirements for a telemarketing merchant account. During this initial conversation, we will discuss your monthly sales volume, previous processing history, current transaction rates, and overall expenses on credit card processing services for your telemarketing venture.

The next step will be document preparation. Our telemarketing merchant services expert will provide you with a list of documents that you will need to prepare for the KYC process. Once you send these documents, they will be forwarded to our acquiring partners. The underwriters will carefully evaluate your application documents and your business profile. We are proud to say that we offer a very high success ratio, so we assume that your application will also be approved.

After the approval of the application, you will receive a telemarketing merchant account agreement. Please carefully read the document and then sign it. After the formalities of signing the merchant account agreement, both parties bid goodbye. You will receive an integration guide and access to the gateway. Your in-house technical team can start working on the integration. Please note that we will also be able to provide you with ready-made plugins for some content management systems.

KYC for Telemarketing Merchant Account

For the approval of a telemarketing merchant account, you will need to submit Know Your Customer (KYC) documents for proper compliance review. This process is important, and submitting all the KYC documents at once will reduce the waiting time for approval. Let’s look at some of the most important documents that you will have to submit for the account approval:

Identification Verification Documents: A government-issued national ID with the photograph of the business owner, such as a driver’s license or passport, and any other ID proof.

Payment processing companies can only work with registered telemarketing businesses. For this, you can submit your business registration. Depending on the type of business structure, the certificate of registration may vary. Depending on the country of registration, you may be required to have any special license for telemarketing activity. If so, you must provide a copy of that license as well.

For the confirmation of the business bank account, you can either provide a letter of good standing from the bank or a voided check. Either of these documents will suffice. These documents help the payment processor confirm that your business bank account is active and is in the same name as your business. Please note that the payment process can only be wired to your business bank account and not to your personal bank account.

If you are already using any merchant account, you must provide the processing history of that account for at least the last 5 to 6 months. A solid history with a very low return and cashback ratio can make an impressive impact on the minds of the underwriting experts.

Additional documents may be required on a case-by-case basis. Ask us today how our telemarketing merchant services solution can help you reduce your payment processing costs.