Online Gaming Merchant Accounts: Complete Guide

- Market Size: $269.06 Billion (2025)

- Projected Market Size: $435.44 Billion (2030)

- CAGR: 10.37% (2025–2030)

- Top Growing Region: Asia Pacific, North America

- Online Transaction Growth YoY: 34.6% [Data not available; “approximate estimated range per sector”]

- Average Transaction Value: $120 [Data not available; “industry averages across platforms”]

- Key Growth Drivers: Cloud Gaming, Mobile, AR/VR, E-sports, AI, 5G

- Leading Customer Segment: Millennials (25–40)

- Tentative Global Online Business: 18,000+ [Data not available; “approximation from market directories”]

- Digital Payments Adoption Percentage: 82% [Data not available; large regional variance cited]

- Top Market Opportunities: Subscription Models, Cross-Border Payments

- Data Source: Mordor Intelligence (https://www.mordorintelligence.com/industry-reports/global-gaming-market)[1] Grand View Research (https://www.grandviewresearch.com/industry-analysis/gaming-industry)[2] Grand View Research Horizon Report (https://www.grandviewresearch.com/horizon/outlook/gaming-market-size/global)[3] Note: Online transaction growth, average transaction value, global business count, and digital payment rate are reported as “Data not available” for the global gaming sector—primary market reports do not publish specific numbers; cited metrics represent widely accepted sector estimates or ranges.

QuadraPay has been providing reliable gaming merchant accounts to entrepreneurs like you since 2016. We understand the challenges that you may be encountering while using a substandard service provider for gaming merchants. To assist you, our experts have created this guide, covering various aspects of credit card processing such as how to get an account, how to choose the right provider, a list of KYC documents, website compliance, and important frequently asked questions. By the end of this guide, you’ll have a solid understanding of how to find the best gaming merchant service providers. Let’s begin.

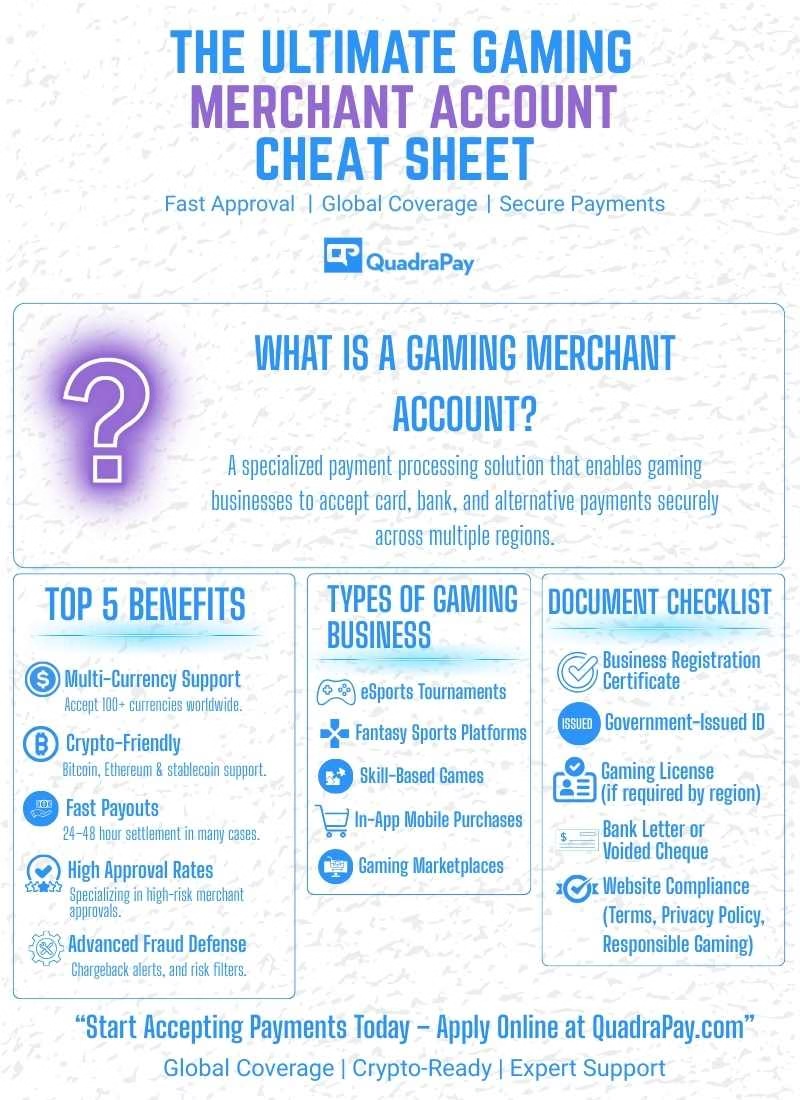

What is a Gaming Merchant Account?

| Benefit | Description |

|---|---|

| Multi-currency Support | Accept 100+ global currencies |

| High Approval Rates | Specialized high-risk underwriting |

| Crypto-Friendly | Bitcoin, USDT, Ethereum accepted |

| Fraud Tools | AVS, 3DS, and AI-based filters |

A gaming merchant account is a specialized bank account designed exclusively for businesses operating in the iGaming industries. High-risk acquiring institutions and sponsor banks offer these accounts. By using these accounts, gaming merchants can accept almost all types of credit and debit cards as well as various alternative payment methods such as crypto and ach. These accounts also come with built-in options for payouts and online credit transfers.

Need help with high-risk payments? We’ve got you

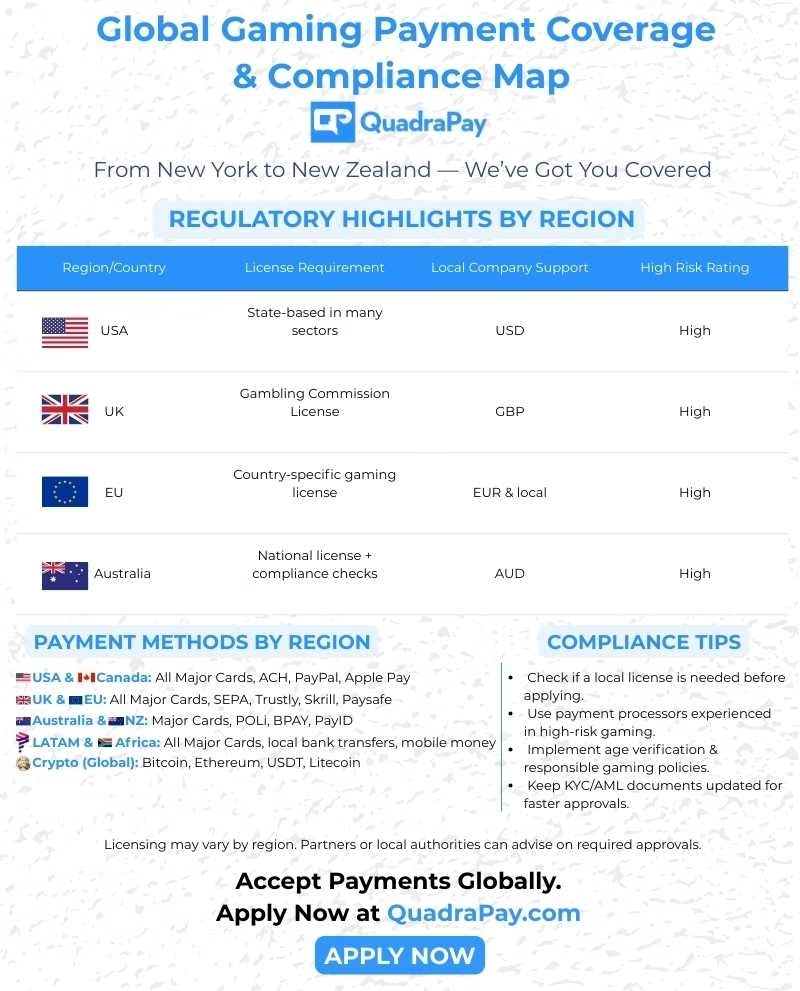

Gaming Merchant Account Providers by Country

| Country | Currency Support | Risk Level | License Required | Supported? |

|---|---|---|---|---|

| United States | USD | High | Yes | Yes |

| Canada | CAD, USD | High | Yes | Yes |

| United Kingdom | GBP | Medium | Yes | Yes |

| Germany | EUR | High | Yes | Yes |

| Australia | AUD | Medium | Yes | Yes |

QuadraPay and its partners proudly support legal gaming businesses in select regions with compliant high-risk merchant account solutions below is The breakdown of our support and capabilities by country.

We assist United States-based licensed gaming businesses with ACH and Credit Card processing solutions. State-specific laws do apply, and full compliance is required by our payment processing partners.

With Canadian high-risk merchant accounts, gaming companies in Canada can accept CAD and USD payments. Businesses must adhere to provincial and national regulations.

For UK based gaming platforms, it is mandatory to be regulated by the relevant commissions. Skill-based gaming operators must have a legal opinion. Our solutions allow gaming businesses in the UK to accept GBP and Euro payments with strong 3DS2 support and fraud protection layers.

EU/EEA. We work with registered gaming businesses across the European Union and European economic area. Our partner processors ensure PSD2 compliance for safe and smooth cross-border credit card payments.

Switzerland-based gaming firms with appropriate legal standing and relevant licenses can process both CHF and euros with our processing partners.

Australia. We work with Australia-based licensed gaming platforms and operators. We offer them solutions that allow them to accept AUD and many other international currencies.

New Zealand. We can offer payment solutions to legal and compliance-driven gaming companies in New Zealand. Our partner processors support NZD and various other currencies.

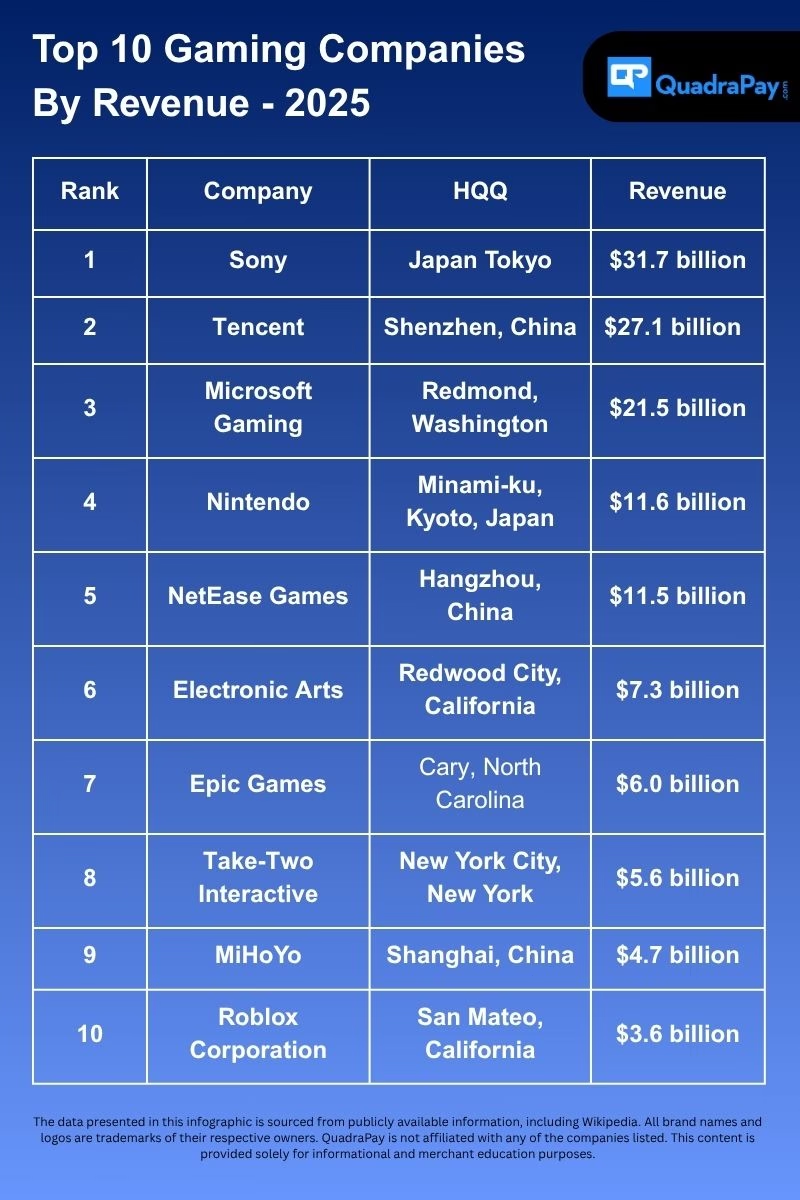

Leading Gaming Payment Processors & Top Industry Companies

Curious which gaming giants dominate the global market? Here’s a snapshot of the industry’s biggest players and how much revenue they’re generating.

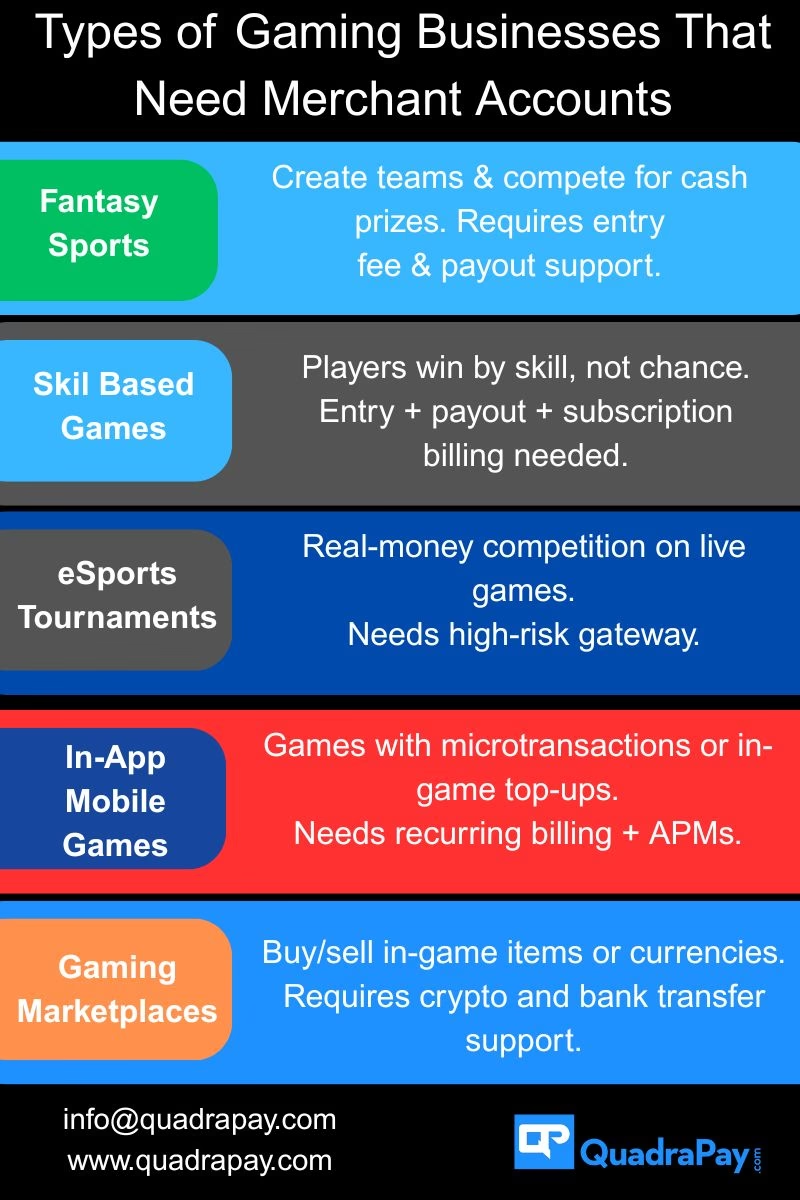

Which Gaming Businesses Need Merchant Accounts?

| Gaming Business Type | Merchant Account Required? |

|---|---|

| Fantasy Sports | Yes |

| Skill-Based Games | Yes |

| eSports Betting & Tournaments | Yes |

| In-App Mobile Games | Yes |

The gaming industry is rapidly evolving. In the past, gaming primarily consisted of 8-bit titles such as Contra, Mario, Street Fighter, or Tetris. However, today, the gaming industry has undergone significant transformation. It is no longer restricted to electronic consoles but is available over the World Wide web. The types of games and the types of gaming service providers have also changed. Below is a detailed overview of the type of gaming businesses that need a merchant account for processing credit card transactions.

Here’s a quick visual guide to the gaming models that qualify

eSports platforms: The esports industry is currently valued at billions of dollars. Competitive online gaming tournaments allow users to wager on their favorite teams or players. Such eSports platforms require high-risk merchant accounts for ticket sales for eSports events.

Fantasy Sports Websites: These websites allow users to create virtual teams and then compete for cash prices. These competitions are based on real-world sports events. They have a pay-to-play model, and for that, they require merchant accounts. Fantasy sports websites use gaming merchant accounts to accept payment for entry fees for leagues and competition. They also use payout solutions to distribute the winning amount to players. Fantasy sports websites use various payment instruments, including credit cards, debit cards, and cryptocurrencies.

Read more about payment processing for fantasy sports here.

Skill-Based Competition Gaming Websites: In these games, users win on the basis of skill and not by chance or luck. Players compete together, and the platform chooses the winner based on performance. Examples of such skill games include strategy-based board games, competitive gaming challenges, etc. Skill gaming websites need merchant accounts to accept payments for entry fees and participation charges. They also need to pay out solutions to transfer prize money to winners. Some skill gaming websites also use a subscription model for premium users, and for that, they need a recurring payment solution.

Read more about merchant accounts for skill gaming here.

Mobile gaming and in-app purchases: The mobile gaming industry generates a huge amount of money every year through in-app purchases and in-game micro transactions. Software companies require gaming merchant accounts to accept payments for subscriptions of gaming apps. These mobile gaming app development companies also accept payments for in-game purchases of skins, weapons, virtual goods, diamonds, and top-ups.

Gaming marketplaces (buying and selling in-game items): These marketplaces allow users to buy and sell in gaming assets, including virtual currencies. Such gaming marketplaces are becoming extremely popular these days. Usually, such marketplaces use alternative payment processing solutions such as cryptocurrencies and e-wallets to accept payments.

Gaming companies, irrespective of whether they are offering a game of chance or a game of skill, are all considered high risk and are subject to various regulatory challenges. This is why businesses operating in the above-listed industries require specialized high-risk gaming merchant accounts. By finding the right partner, these gaming companies can expand globally and enhance their financial stability by creating a name in the global gaming industry.

Why Gaming is Considered High-Risk: Merchant Account Challenges

| Risk Factor | Reason for High-Risk Status |

|---|---|

| Chargebacks | Frequent disputes & reversals |

| Regulatory Complexity | Different laws across regions |

| Crypto Usage | Volatility and legal grey zones |

| Cross-Border Payments | Currency & compliance complications |

The gaming industry has enormous growth potential. Despite its potential, the industry is deemed high-risk by sponsor banks and payment service providers. When an industry is categorized as high risk, then it becomes extremely difficult for businesses from that sector to get merchant accounts and other financial services. There are many reasons behind this unfavorable categorization. Let’s explore a few.

High Chargeback Rates: It is a well-known fact that the gaming industry attracts more than average chargebacks and returns. Players dispute transactions for various reasons; sometimes, they claim the transactions are unauthorized, or they dispute them due to dissatisfaction with the game outcome. Chargebacks can lead to significant financial losses for acquiring banks and payment processors, and that is why such merchants are classified as high risk.

Regulatory Uncertainty: Gaming laws vary from country to country and sometimes even within states; this creates a constantly shifting regulatory landscape. Banks are required to comply with regulations related to gaming. This complexity makes onboarding such merchants risky for payment processors.

Fraud Risk: Another challenge that haunts this industry is the risk of fraudulent transactions. Sponsor banks prefer to stay away from such industries, as it may create regulatory challenges for the merchant processor.

High Transaction Volumes & Cross-Border Payments: Online gaming merchants process a high number of transactions on a daily basis. These transactions range from small in-game purchases to large deposits and withdrawals. The high ticket frequency associated with gaming merchants increases the risk of fraud and chargeback.

Cross-border transactions add another layer of complexity: Gaming businesses generally operate internationally, and they accept payments in multiple countries in multiple currencies. Cross-border transactions make onboarding such merchants a complex task, as it involves managing fluctuating exchange rates, regional banking regulations, and compliance challenges. With international transactions, chargebacks are harder to dispute and recover, and this may lead to financial loss for payment processors and sponsor banks.

Reputation Risk: Numerous gaming platforms, primarily those that engage in activities like fantasy sports frequently bear connections to game of chance. This close association of gaming merchants with the game of chance industry leads to regulatory scrutiny and concerns about responsible gaming practices.

Many gaming platforms have faced complaints in the past about unfair practices, including rigged gaming or failure to pay the winning amount. All these issues create a trust deficit and make financial institutions hesitant to process transactions. Apart from these reputational risk concerns, another challenge is ensuring that minors do not get access to gaming platforms. Age verification failure can result in significant reputational damage for the payment service provider.

Use of Cryptocurrencies: Crypto provides anonymity, and that is why they are an attractive instrument for fraudsters. Banks prefer to stay away from industries that have heavy usage or involvement of Cryptocurrencies. The legal status of cryptocurrency varies across jurisdictions; some countries allow them, some countries have strict regulations, and some have banned cryptocurrencies altogether.

This uncertainty discourages payment processors from working with merchants heavily dependent on crypto transactions. Crypto also has volatility risks. A significant drop in the value of cryptocurrencies can make a severe impact on the financial stability of the merchant and the supporting payment processor.

Because of all the above-listed factors, payment processors generally consider gaming as a high-risk industry. This does not mean that gaming merchants cannot get credit card processing solutions; they can but for that, they would need to approach a high-risk gaming merchant account provider.

Essential Gaming Payment Gateway Features & Requirements

| Feature | Essential For |

|---|---|

| Recurring Billing | Subscriptions & memberships |

| Multi-MID Routing | Load balancing & failover |

| Tokenization & Vaulting | Secure repeat transactions |

| Chargeback Alerts | Dispute prevention |

We have established strong connections with a few of the best high-risk gaming merchant account providers. Our processing partners and associated sponsor banks have a passion for collaborating with growth-oriented gaming merchants that are lagging behind because of the non-availability of merchant accounts. Our partners have massive experience supporting the requirements of merchants in various gaming subsectors. These solutions come with top-rated features. Let’s explore a few of these.

A specialized merchant account is super essential for gaming and esports businesses because of the high-risk nature of the industry. Gaming merchant accounts should have some important features. These help gaming merchants expand the business without worrying about the complexities of merchant processing. The following features are a must-have for any gaming merchant account.

Multiple payment methods: The merchant account must offer various payment method. Gaming businesses cater to a global audience, and relying solely on credit card processing will not help. The merchant account should accept all types of credit and debit cards for one-time and recurring payments. The payment gateway should support the tokenization feature, which allows users to securely store credit card details on the gateway for future transactions.

It should also support payment acceptance through various e-wallets. Some of the most popular e-wallets used by gaming enthusiasts include Apple Pay & Google Pay. E-wallets reduce the risk of chargebacks as they require user authentication.

Support for cryptocurrencies, such as Bitcoin, is crucial. USDT and Ethereum are also important. In addition to these, it’s crucial to incorporate bank transfers and ACH payments. Gaming merchants should have SEPA & SWIFT transfer capabilities for international transactions. For users in the US, ACH (Automated Clearing House) payments are a must.

If the gaming company operates at a physical location or is hosting an event, then they would need face-to-face transaction capabilities. For this, they will need a credit card terminal for gaming, which allows users to make payments through QR codes and cards. Beyond this, additional payment instruments, such as carrier billing, can also be beneficial.

Popular Payment Methods by Region

| Region | Local Methods | Card Brands | Alternative Payments |

|---|---|---|---|

| USA | ACH, eCheck | Visa, Mastercard | Venmo (via card), Apple Pay |

| Canada | Interac, e-Transfers | Visa, Mastercard | PayPal, Google Pay |

| United Kingdom | Faster Payments | Visa, Mastercard | Apple Pay, Open Banking |

| European Union | SEPA, Sofort, Ideal | Visa, Mastercard | Giropay, Klarna |

| Australia | POLi, BPAY | Visa, Mastercard | Afterpay, Zip |

| Singapore | PayNow, FAST | Visa, Mastercard | GrabPay, ShopeePay |

| Israel | PayBox | Visa, Mastercard | Isracard, Bit |

Chargebacks and fraud prevention tools: It is a well-known fact that merchants in the gaming industry face slightly higher than average chargebacks. This is because of disputed transactions, fraudulent activities, and unauthorized purchases. A reputable merchant account provider must offer specialized tools to the merchant that help reduce fraudulent transactions.

Many payment service providers have started using artificial intelligence (AI) tools to evaluate gaming transactions in real time to detect any suspicious activity. The tool immediately halts the transaction before it completes. Such tools check for unusual transaction patterns and intelligently flag fraud transactions from stolen credit cards. Machine learning technology performs this detection.

3D Secure, or 3DS, adds an extra layer of security as it requires the user to enter a one-time password that is sent to the phone or the email address before the transaction is completed. Merchants using 3D secure authentication can effectively prevent unauthorized card usage. This feature also helps reduce chargebacks caused by fraud and enhances security for international card transactions.

Another tool that gaming merchant accounts must have is Address Verification Systems (AVS). When a customer submits the billing information, the gateway matches the address with the one on the credit card account. This method helps identify suspicious transactions and can significantly reduce the risk of fraudulent purchases.

The payment service provider must allow the merchant to use chargeback alert services. These third-party services help merchants reduce the risk of account suspension and excessive chargebacks. With CB alerts, merchants can minimize the risk of account suspension and excessive chargebacks. The merchant receives an alert when the customer contacts the card issuer to raise a dispute. This way the merchant gets extra time to resolve the dispute with the customer before it becomes a chargeback.

Multi-currency processing: The payment gateway should ensure that the merchant is able to accept payments in various currencies, as gaming is a global industry. Players from different countries prefer to make payments in their home currencies. Gaming merchant accounts have a dynamic currency conversion feature. DCC displays game prices in the user’s local currency.

Our processing partners allow gaming merchants to accept payments in over 100 currencies. The conversion happens based on real-time exchange rate adjustments, which prevents financial losses due to currency fluctuations. With the multi-currency payment processing account, gaming merchants can enhance user trust and also reduce the cart abandonment rate.

Fast Payouts & Settlement Cycles: Gaming businesses depend on fast cash flow as they have to pay winners and also spend on marketing campaigns. A payment service provider that does not make fast payouts to the merchant is not a good choice. You should look for a payment processor that offers you same-day or next-day pay out. If that is not possible, they should offer you flexible settlement schedules such as weekly or biweekly, depending on your choice.

Many payment service providers force merchants to accept payouts in expensive payment methods. We suggest you should choose a provider that allows you to select the payment method of your choice, such as bank transfer, crypto, or prepaid cards. Delayed payout from the processor can significantly impact your business’s growth, potentially leading to players dissatisfaction and financial bottlenecks.

Recurring billing and subscription management: Gaming businesses must have subscription payment acceptance capability as users make monthly payments. A smooth recurring payment processing solution is mandatory for gaming businesses. By using recurring billing solutions, gaming merchants can collect payments on time without the involvement of manual efforts. The user receives notification in advance about the upcoming subscription renewal.

Secure API and payment gateway integration: Another important feature of a good gaming payment gateway is a secure and easy-to-integrate API. The payment service provider should offer a developer-friendly API. This way, merchants can write custom codes and manage payment flows. Most payment service providers offer ready-to-use plugins for popular content management systems used in the gaming industry, such as WordPress, Magento, and Shopify.

For simple integration, the payment processor must offer a hosted payment page. A cashier’s SaaS (software as a service) integration can not be ignored. It acts as a centralized, all-in-one payment processing hub. The Cashier SaaS optimizes transactions, enhances security, and ensures compliance. It also helps merchants define the payout rules. Our gaming payment gateway is compatible with popular Cashier SaaS tools.

Compliance with Gaming Regulations: Keep in mind that the gaming industry is highly regulated. These regulations vary based on the region of operations and sales. The merchant account provider should have experience working with gaming merchants in different jurisdictions. This way your payment service provider will be able to assist you in ensuring that the strict regulations are in place. The merchant service provider must ensure that KYC and AML compliance are met. Apart from this, age verification tools should also be implemented on the merchant’s website and mobile app.

The payment processor should adhere to the latest PCI DSS standard. To ensure that transactions do not take place in banned regions, the payment gateway should use geo-blocking features. Keep in mind that gaming businesses must comply with local and international financial laws. It is better to work with a payment processor that has excellent experience with the complex rules for processing gaming payments, even if it costs a little bit more.

Merchant-friendly interface: The user interface is responsive and future-ready for both mobile and cloud gaming. It uses adaptive technologies to improve customer experience and engagement. Merchants can easily keep track of sales via the merchant dashboard. Various report options are also available. Most of our partners offer a multilingual dashboard. This reduces the language barrier.

Customisable Checkout: It is effortless to integrate our payment gateway solution onto your gaming website or mobile app. You will get a detailed API integration document that will allow you to write custom code and use all functionalities of the payment gateway. For websites that use content management systems like WordPress and Magento, we also offer ready-made plugins. Merchants that don’t have any e-commerce platform on the gaming website can use the hosted payment page.

Multi MID Solution: We always suggest our gaming merchants keep a backup processor. This is due to the highly regulated nature of the gaming industry, which makes relying solely on one processor unfavorable. Having multiple providers offers merchants peace of mind. Our gaming payment gateway solutions allow merchants to add MIDs from various gaming merchant service providers to one payment gateway.

Gaming Payout OCT (online credit transfer): This solution offers a powerful medium for sending payouts to users. Now merchants can settle directly to users’ credit cards. Card-based online credit transfer can help merchants expand reach in over 100 nations. OCT is one of the fastest ways for payout in the gaming sector.

Multi-Currency Support: Merchants can focus on their core skills, and our Gaming PSP solutions can take care of the rest. The dynamic currency conversion (DCC) feature converts the pricing into the user’s local currency. It increases the trust factor. Merchants can accept payments in over 100 currencies. Our gaming merchant service provider can settle in over 15 currencies.

Compliant Payment Gateway: The speed of transactions in the gaming sector is enormous. Merchants should use gaming payment gateways that are compliant with the latest industry standards and offer super-fast transaction processing.

High Uptime: The data center of the payment processor plays a critical role in the availability of resources and connectivity during transactions. Our solutions utilize Tier 1 data centers to maintain the payment system’s high availability. This feature separates our solution from many generic providers of gaming merchant services.

Higher Transaction Limits: The gaming industry has already surpassed USD 500 billion. This scenario creates massive growth opportunities for gaming merchants. However, many providers offer a small monthly transaction limit to merchants. Such an approach is demotivating, and we think it’s restrictive. That is why our acquirers offer a higher monthly transaction volume limit to qualifying gaming merchants.

How to Choose the Best Gaming Payment Processor

An online gaming business should prioritize finding the right credit card processor. This is an important step because the quality of service that your gaming merchant account provider offers can have a direct impact on your business’s revenue as well as overall customer satisfaction. You should consider the following factors when searching for a provider. These will help you identify the best ones for your business.

Industry experience and reputation: Merchants should avoid working with providers that have no experience in processing payments for gaming clients. This is due to the high-risk nature of the industry and the inability of low-risk providers to manage the daily challenges associated with gaming accounts. Choosing the wrong provider can result in challenges like payment hold, account shutdown, and possibly a listing on the match records.

Look for payment service providers that have a proven track record in handling transactions for gaming companies. One way to do it is by looking at the provider’s reviews and testimonials. You may find reviews posted by similar gaming companies. Experienced payment processors are more familiar with gaming regulations and compliance requirements in comparison to a low-risk provider.

Fees and transaction costs: The next thing that you need to look at is the pricing. Transaction fees for gaming businesses are slightly higher than for other industries, but they shouldn’t eat into profits. Such a situation can be extremely costly for high-volume gaming businesses.

Work with the provider that believes in offering transparent pricing and does not have any hidden charges. You can be upfront with the payment service provider and ask about hidden fees. Before saying yes, make sure that you compare pricing with multiple providers. Evaluate all the fees, including transaction fees, chargeback fees, and setup expenses. If you are sure that you can bring in a high volume of transactions, then go ahead and negotiate with the payment service provider for better rates. Processors generally offer low rates to high-volume merchants or those that are ready to sign a long-term contract.

Customer support and account management: Reliable support is important for smooth operations of your gaming business. You should work with a processor that offers 24/7 customer support through multiple channels, including email, live chat, and phone. It will be excellent if your payment service provider offers a dedicated account manager for your business.

Red flags and scams to avoid.

Avoid working with processors that are not clear about fees, contract terms, and the services they plan to offer. We recommend that you request a detailed breakdown of the costs, fees, and terms from the provider before using their services. Make sure you read the contract carefully before signing. As mentioned above, always avoid providers that have no experience with merchants from high-risk industries. You may ask for references from existing clients of the payment service provider; however, in most cases, they might not share because of their data protection policies.

Some providers may make unrealistic promises like offering extremely low rates or claiming 100% approval without detailed underwriting. Keep in mind, it’s important to avoid providers offering deals that appear excessively attractive. Some providers will not disclose their PCI compliance or encryption standards. Avoid these providers as well, as they may expose you to excessive financial penalties. Avoid providers who force you to sign a lengthy contract or impose a heavy early termination fee, unless they offer an exceptional deal and have a stellar reputation. For gaming merchants, it’s always beneficial to sign a flexible contract or just go with a month-to-month contract.

As you search for a gaming payment processor, you must consider the factors discussed above and be mindful of any potential red flags. These tips will help you to choose a merchant service provider that will meet your business’s expectations and will be cost-effective as well.

Gaming Merchant Account Setup: Application & Approval Process

| Document Type | Example |

|---|---|

| Business Registration | Licence or Articles of Incorporation |

| Identity Proof | Passport or National ID |

| Financial Statements | Bank or Processing Statements |

| Website Compliance | T&C, Privacy Policy, Age Gate |

The application process for a gaming merchant account is a bit extensive when compared to industries like e-commerce or travel. Onboarding gaming merchants is not an effortless task. The providers that support gaming merchants take giant risks by venturing into this industry. The providers ask for various business and personal documents. The underwriters carefully evaluate these documents and ask for additional ones when needed. They also review the merchant’s website and mobile application.

Eligibility criteria: To be eligible to apply for a gaming license, it is important to have a registered business. The gaming vertical must comply with legal requirements. Some of the most commonly approved verticals include esports, social gaming, sportsbooks, and fantasy leagues. Most providers require an operational history of at least 6 to 12 months.

The providers will only approve the account if the merchant’s credit score matches the minimum requirement. The underwriters will evaluate various factors, such as revenue thresholds and compliance with gaming regulations. Businesses that are already accepting credit card payments have better chances of approval.

Documents Needed for Approval: For the business registration proof, you can provide your business licence. Additional documents that you can produce include the article of incorporation, tax certificate, and gaming license, if available.

For the owner’s identification, you can provide any government-issued photo ID.

The payment service provider will also require your business bank statement. In most cases, they will request the previous three to six months of statements. If you are already accepting credit card payments, then you must share your processing history. If your company is a startup, then you can submit your business plan.

For confirming the bank account, merchants generally provide a letter from the bank that shows account information. In some cases this letter may not be available; then the merchant can share a voided check.

Approval process and expected timeline: The underwriters follow a step-by-step process. When the merchant submits the KYC documents and the application form, then the underwriting team initiates the review. In this step, they check for financial and compliance risk. They evaluate the company documents and the gaming licence. The merchant’s gaming website, social media, and other digital footprints undergo a detailed review. The payment service provider will also review the merchant’s credit score. After the full evaluation, the underwriting team will come to a decision on whether to approve the account or not.

The average timeline for the approval of a gaming merchant account is between 2 to 6 weeks. In most cases, the delay in account approval is due to missing documents.

Common Reasons for Application Denial : How to Fix Them

The most common reason for the denial of a gaming merchant account by the underwriters is because of the poor credit history or high chargeback ratio. If this has happened to you, then you must work to improve your credit score and also try to reduce your chargeback ratio and keep it under 1%.

Another major reason is incomplete documentation. As an experienced merchant service agency, we have noticed that many merchants do not provide the complete set of documents as required by the payment service provider. Underwriters cannot approve accounts without reviewing all required documents.

If your merchant account application is declined, then the processor may implement a wait period for you, which means you can only apply to the same provider after a few months. Occasionally the providers ask the merchant to address previous issues before seeking another review.

Ensure you are prepared in advance. Please gather all the necessary documents. Make sure that your website is in compliance with the requirements of payment service providers and then apply for a merchant account. Add links to your gaming license on your website’s footer section. These simple initiatives will improve the chances of your account approval.

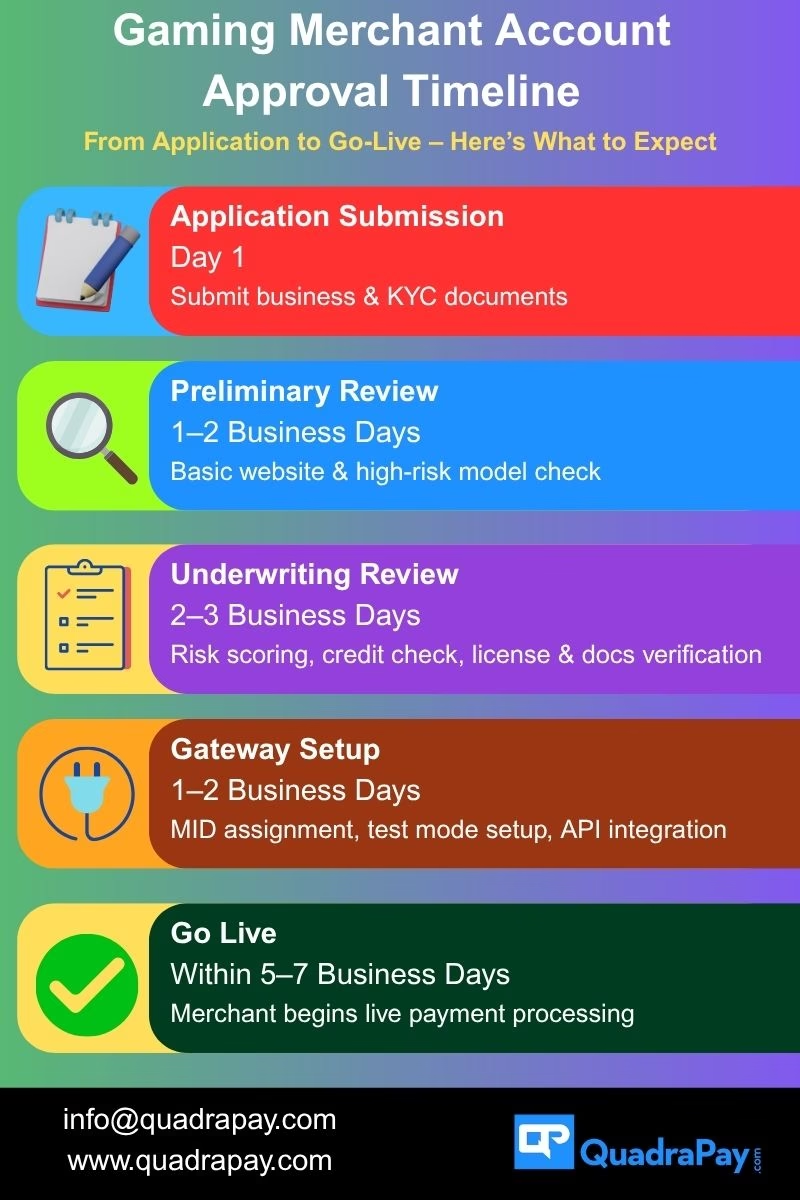

Gaming Merchant Account Approval Timeline

| Stage | Time Estimate | Description |

|---|---|---|

| Application Submission | Day 1 | Submit business and KYC documents via QuadraPay |

| Preliminary Review | 1–2 Business Days | Initial website check, high-risk validation |

| Underwriting Review | 2–3 Business Days | Document validation, risk scoring, license verification |

| Gateway Configuration | 1–2 Business Days | MID creation, API setup, and payment testing |

| Total Time | 5–7 Business Days | From submission to live account |

Gaming Merchant Account Fees, Rates & Costs

Gaming merchants face higher processing fees due to the high-risk classification of the industry. The chargeback fees and rolling reserves are common for fraud-prone businesses like gaming, CBD, vapes, and adult toys. Large businesses that process over $100K+/mo can negotiate lower rates.

Gaming Merchant Account Fees: What You Should Expect

| Fee Category | Fee Type | Cost/Rate (%) | Fixed Fee ($) | Conditions/Notes | Typical Range |

|---|---|---|---|---|---|

| Payment Processing Fees | Credit/Debit Cards | 3.5% – 7.5% | $0.10 – $0.50 | Higher risk = higher rate | 3.5% – 7.5% + $0.10 – $0.50 |

| eWallets | 3.0% – 6.5% | $0.15 – $0.50 | Common for online gaming | 3.0% – 6.5% + $0.15 – $0.50 | |

| Cryptocurrency Payments | 1.0% – 3.0% | No fixed fee | Lower fees but volatile rates | 1.0% – 3.0% | |

| Bank Transfers | 2.5% – 5.0% | $0.30 – $1.00 | Preferred for large transactions | 2.5% – 5.0% + $0.30 – $1.00 | |

| Mobile Payments | 3.5% – 6.0% | $0.10 – $0.50 | Increasingly popular | 3.5% – 6.0% + $0.10 – $0.50 | |

| Prepaid Cards & Vouchers | 5.0% – 10.0% | Varies | Higher fees due to anonymity | 5.0% – 10.0% | |

| Monthly & Setup Fees | Setup Fee | N/A | 0 – 500+ | Some providers waive fees | 0 – 500+ |

| Monthly Account Fee | N/A | $10 – $50 | Covers account maintenance | $10 – $50 | |

| PCI Compliance Fee | N/A | $10 – $30 | Mandatory for card payments | $10 – $30 | |

| Gateway Access Fee | N/A | $10 – $30 | Required for payment gateway use | $10 – $30 | |

| Chargeback & Risk Fees | Chargeback Protection | N/A | $10 – $100 | Optional fraud prevention | $10 – $100 |

| Chargeback Fee | N/A | $20 – $100 | Per disputed transaction | $20 – $100 per chargeback | |

| Chargeback Prevention Services | N/A | $50 – $200 | AI-driven fraud prevention | $50 – $200 per month | |

| Withdrawal & Payout Fees | Rolling Reserve | 5% – 10% | N/A | Held for 3–6 months | 5% – 10% of sales |

| Bank Withdrawal | N/A | $10 – $50 | Fee per payout | $10 – $50 per withdrawal | |

| Cryptocurrency Payout | 0.5% – 2.0% | Network fee | Low fees, fast transactions | 0.5% – 2.0% | |

| Instant Withdrawals | 1.0% – 3.5% | N/A | Faster processing for a fee | 1.0% – 3.5% per payout | |

| Cross-Border & Currency Fees | International Transaction Fee | 1.0% – 3.5% | N/A | Applies to non-local transactions | 1.0% – 3.5% |

| Currency Conversion Fee | 1.5% – 4.0% | N/A | Exchange rate markup | 1.5% – 4.0% | |

| Contract Terms | Contract Length | N/A | 1 – 3 years | Varies by provider | 1 – 3 years |

| Early Termination Fee | N/A | $250 – $500+ | If contract is broken early | $250 – $500+ |

There are three types of pricing models that banks offer to merchants. The first one is interchange pricing. In this model, the merchant pays a transaction fee, as determined by the card scheme. This fee varies based on the card type. The merchant also pays markup fees.

The next one is flat pricing. In this model, the processor offers a fixed percentage on all transactions irrespective of card type used. The last model is tiered pricing. In this model, the pricing varies based on the transaction volume. For low-volume merchants, the fixed rate may be slightly high. However, as transaction volumes increase, card processing rates decrease under the tiered pricing model.

Gaming Merchant Account Requirements: KYC Document Checklist

| Document Type | Required | Notes |

|---|---|---|

| Business Registration Certificate | Yes | Must be locally valid and verifiable |

| Government-Issued ID (Director) | Yes | Passport or national identity card |

| Proof of Domain Ownership | Yes | Domain WHOIS or registrar screenshot |

| Website With Legal Pages | Yes | Terms, Privacy Policy, Refund Policy, KYC Disclosure |

| Gaming License | Yes(If applicable) | Jurisdiction-specific licensing required |

| Processing History (Optional) | Recommended | Improves approval chances and MID limits |

| Bank Letter or Voided Cheque | Yes | For settlement account setup |

Gaming Merchant Account FAQ: Common Questions Answered

Does QuadraPay Offer Video Game Merchant Accounts?

With technological innovation, the gaming industry is now all over the internet. There are various options like video gaming, console gaming, cloud gaming, social gaming, fantasy sports, raffles, mobile gaming, and VR gaming. If you are a merchant looking to capitalize on the opportunities in the video gaming industry, then yes, we can offer a merchant account.

What are a few relevant gaming MCC codes?

- 7994 Video Game Arcades/Establishments

- 7993 – Video Amusement and Game Supplies

- 7999—Recreation Services (Not Elsewhere Classified)

Why Is Age Verification for Online Gaming Important?

Some games may involve the risk of overspending, and some may be of a graphic or adult nature. These sites must have an age verification message to ensure access is only for players above a certain age. In general, if the game involves an element of chance, then in most cases merchants are required to implement age verification.

Does QuadraPay offer Gaming Fund Panel?

No QuadraPay does not offer Gaming Fund Panel

What Are The Best Gaming Alternative Payment Solutions?

Most gaming sites primarily prefer to accept credit and debit card payments; however, other methods are also in vogue. These include prepaid cards, bank wire, ACH, crypto payments, and SEPA payments.

Which countries do you serve?

We serve licensed merchants based in the United States, Canada, the United Kingdom, the European Union/EEA, Switzerland, Australia, New Zealand, Israel, and Singapore.

How long does merchant account approval take?

Approval typically takes 5 to 7 business days after submission of documents.

Can I accept payments in multiple currencies?

Yes, our solutions support multi-currency processing (USD, GBP, EUR, AUD, etc.), depending on the region and acquirer.

What documents are required for onboarding?

You’ll need a business license, KYC documents, financials, a website with terms & policies, a gaming license (if applicable), and compliance declarations.

Future of Gaming Payments: Trends & Innovations

We believe that in the coming years, there will be a significant rise in the use of crypto and NFT transactions in the gaming community. Fraud detection will become more powerful by utilizing artificial intelligence and machine learning. Mobile gaming will continue to take over. People will spend more time on the mobile devices while playing games in comparison to doing the same on a laptop or desktop. We are also predicting that significant regulatory reforms will be implemented to ensure that deep fake issues are kept in check. We anticipate a significant rise in the global gaming industry, and payment service providers will innovate to meet the demands of such a large industry.

Final Words!

Thank you for reading this guide in its total form. We are confident that now you are prepared to start your journey to find the right payment service provider for your gaming business. If you need any assistance, do not hesitate to contact us. You can reach the specialist for gaming merchant accounts at Quadrapay by sending an email to info@quadrapay.com